- How we help you

The 2021 Post-Brexit Hauliers Survey

With surging demand for UK haulage in 2021, what industry-specific challenges are being faced by haulage companies?

Tristan Bacon — Updated

With surging demand for UK haulage in 2021, what industry-specific challenges are being faced by haulage companies?

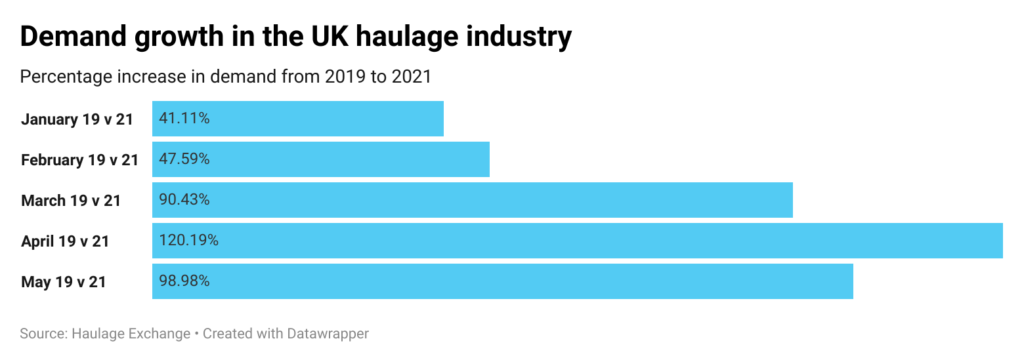

As we move deeper into 2021 and further away from the 1 January 2021 Brexit transition date, it’s time to assess the current state of the haulage industry. It’s clear that there is an unprecedented need for haulage – caused partly by the pandemic-fuelled rise in internet shopping – with demand in April 2021 120% stronger than in April 2019.

In the three months from March to May 2021, the uplift in demand for haulage was more than twice what it was for the same period in 2019.

As the UK’s leading haulage return loads platform, we can provide unique, month-on-month insights into load transfer demand, from hauliers up and down the country. With the industry thriving thanks to increased demand and continuing to successfully adapt to ongoing changes, we spoke to those on the front lines of the industry – to explore upcoming challenges and hear their predictions for the future. We surveyed employees from 16 of the UK’s top haulage companies that operate in the UK and Europe, with fascinating results.

Key findings:

- 120% higher demand in April 2021 than in April 2019

- Two-fold increase in haulage demand for March-May 2021 when compared to March-May 2019

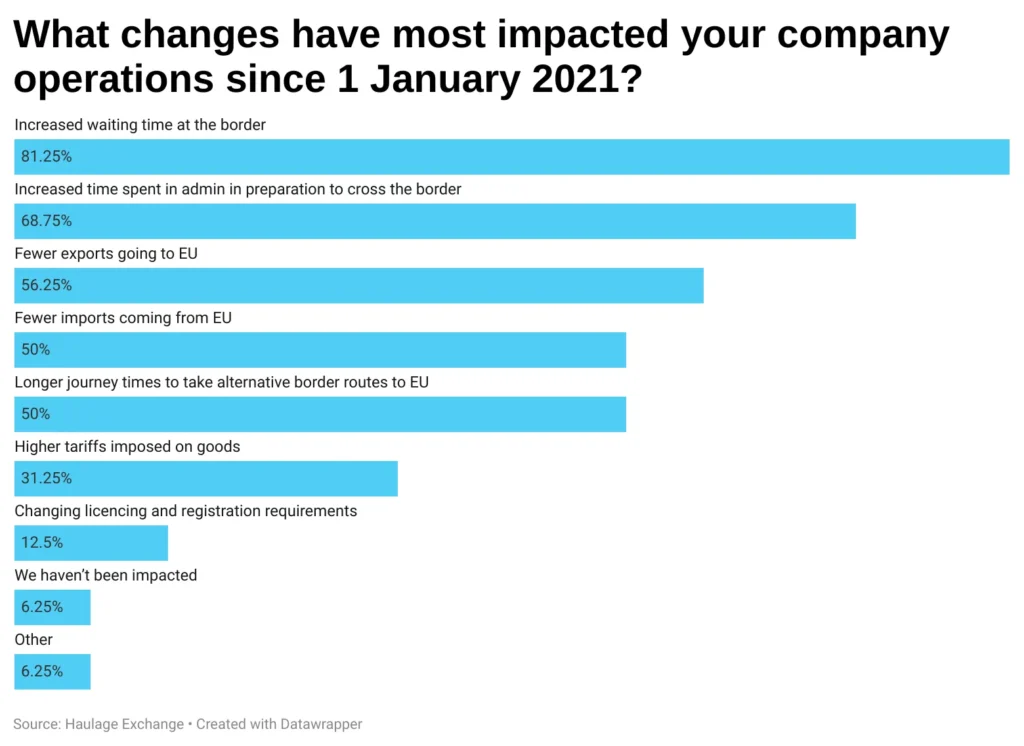

- When asked about challenges, 81% experience increased border waiting times

- 69% spend more time doing admin before crossing the border

- 19% no longer do business with EU companies

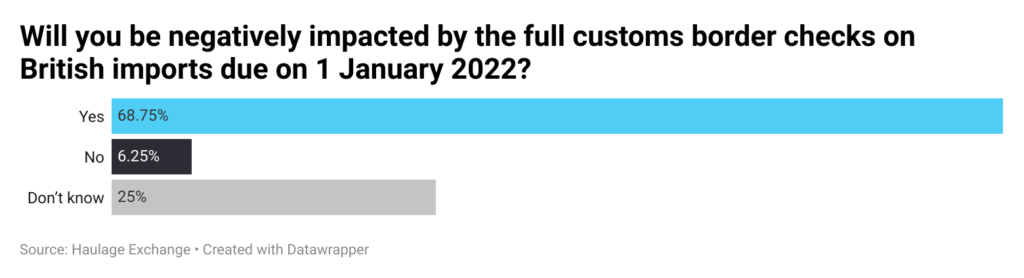

- 69% expect to be negatively affected by full border checks on incoming goods on 1 January 2022

How are haulage companies adapting to higher demand and Brexit impacts?

Only now are we starting to see a true picture of how Brexit will affect cross-border haulage with the EU. Although full border inspections won’t begin until 1 January 2022, companies continue to adapt to new regulations and prepare for the new-look landscape.

Just as many – both in and outside the industry – predicted, most (81%) haulage companies have faced longer waiting times at the border. Allied to this, 69% have found themselves spending more time on paperwork related to border crossings. Unsurprisingly, many companies have explored alternative routes into the EU, but half of the firms we surveyed say they’ve experienced longer journey times on these routes.

Some 56% of hauliers say business has been affected by fewer exports going to the EU, while half say their operations have been impacted by fewer imports coming in. Despite this, demand has not only proved robust, but has increased dramatically.

When asked what challenges Brexit was posing for the industry, 6% of companies say they haven’t seen any impact on their business since Brexit came into force on 1 January 2021.

By comparing the results of this latest 2021 Post-Brexit Hauliers Survey to the UK Hauliers Brexit Transition Deadline Survey we commissioned just before 1 Jan 2021, we can see that hauliers have a solid understanding of Brexit, their industry and upcoming issues. They are facing unique challenges, but strong growth will help haulage companies to meet them head on.

Increased waiting times at the border, for example, have affected 6% more respondents than thought they would be impacted. More time doing admin to cross the border was another factor for many companies, with 3% more respondents experiencing this than the 66% who expected it back in December 2020.

Some anticipated issues haven’t materialised for many companies though. Higher tariffs imposed on goods have affected 31% of respondents, but 50% of companies had been expecting those: a drop of 19% in reality versus expectation.

Fewer hauliers have also experienced changing licencing and registration requirements than thought they would. There’s a 29% difference between the amount of respondents expecting that issue and those actually dealing with it after Brexit.

Even at this early stage, it’s clear that Brexit has had a profound effect on the UK’s haulage industry. When we asked hauliers just how Brexit has affected them, 69% said it has caused them to lose business, while 19% are no longer working with EU companies. In addition, a quarter (25%) feel unable to plan properly due to ongoing uncertainty.

What are the wider impacts of Brexit on haulage companies?

One underreported aspect of Brexit’s effect on hauliers is the impact of the transition itself: on people, companies and society.

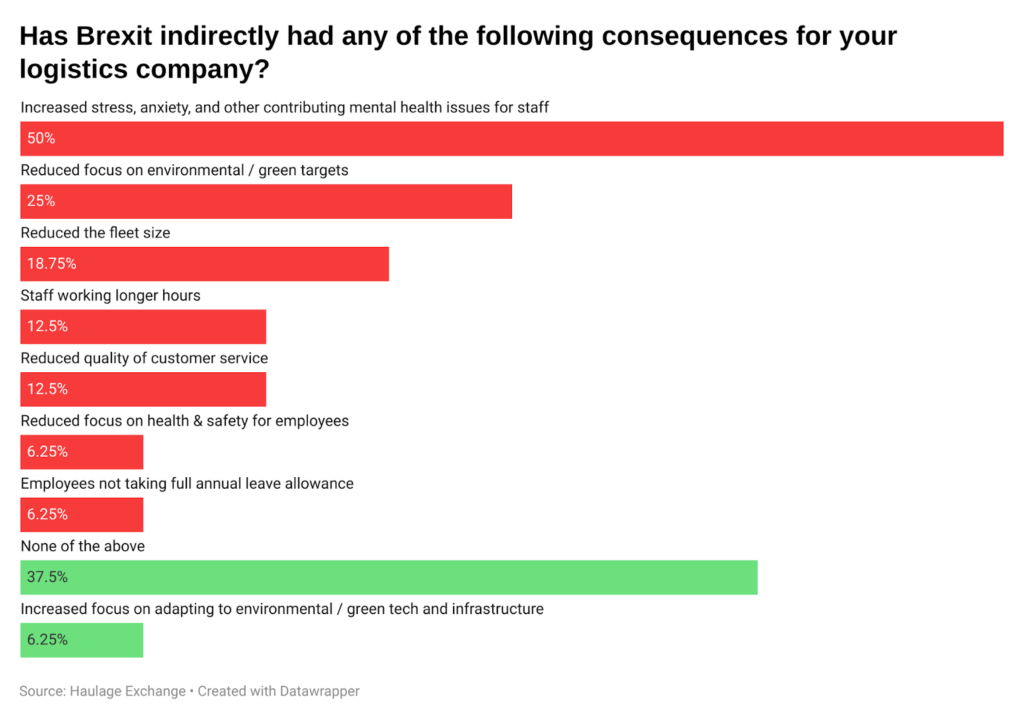

An increase in stress, anxiety and other mental health issues were highlighted by 50% of respondents to our survey. Related to this, 13% say staff are working longer hours, while 6% say employees aren’t taking their full annual leave allowance.

Our study also uncovered a reduced focus on environmental targets, with a quarter (25%) of respondents noticing this at their company.

How are haulage companies reacting to changes?

With the haulage industry at the very forefront of Brexit-induced changes, haulage companies have quickly realised the need to adapt the way they work. Representing a potentially seismic shift, our study found that 56% of haulage companies have moved some operations to the EU, or would consider it in the future.

Rising haulage costs will be felt by UK businesses in various industries, with 69% of haulage firms in our survey having already increased costs. The remaining 31% say costs will be rising next year or in the near future.

How have Brexit changes impacted different businesses and industries?

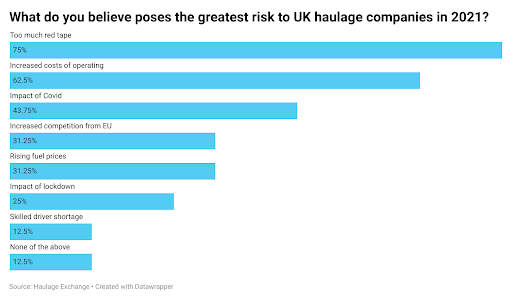

As UK lockdown restrictions ease, many sectors are only just beginning to face staff shortages, but in the haulage industry, demand for drivers has been outstripping supply for some time. According to our data, one in every 8 haulage companies identify skilled driver shortage as a significant risk to the industry in 2021. Research has suggested that as many as 12,000-15,000 have left to find work elsewhere.

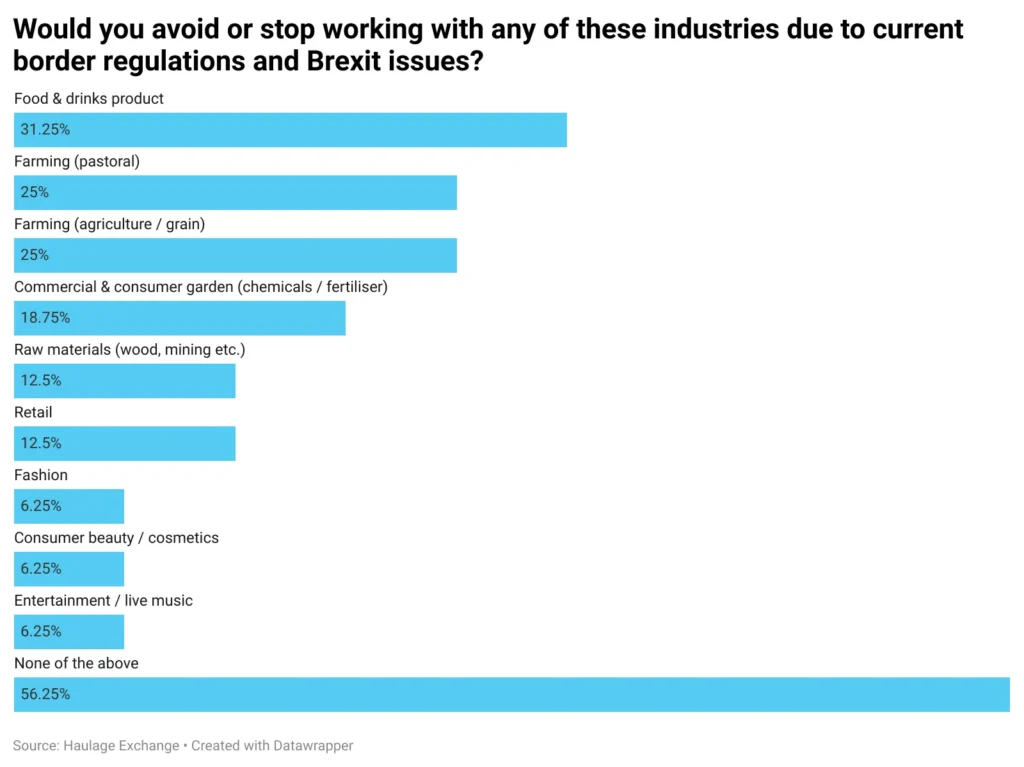

The knock-on effect of this driver shortage is that some industries have been unable to find enough hauliers to transport their products. Certain products are also subject to increased checks and admin, creating additional barriers for haulage companies’ transporting such goods.

Almost a third (31%) of respondents to our survey say they would avoid working with food & drinks industry clients due to border and Brexit issues. Other sectors they are reluctant to work with include livestock farming (25%), agricultural farming (25%), gardening supplies (19%) and retail (13%).

Our study highlights how small businesses are being affected by Brexit’s haulage impact. Some 63% of haulage companies say they do less business going from the UK to the EU with SME companies (with under 100 employees). Going from the EU to the UK, 56% of hauliers say they do less business with SMEs in that direction.

Contrast that with the figures for multinationals (with more than 1,000+ employees): 38% of hauliers do less business exporting from the UK and 25% less business importing into the UK.What does the future look like for UK hauliers?

We asked hauliers if they believe that it’s sustainable to continue operating with the current Brexit changes to border regulations. Almost a third (31%) say they’re adapting their business model to survive.

- We’re having to adapt our business model to survive – 31%

- We won’t stay in business as it currently stands – 25%

- We are planning for operations to continue at a reduced Q1 level – 18%

- Our company will grow and increase operations with Brexit changes – 12%

- We’ll continue to operate with lower margins – 6%

- Our company hasn’t been negatively impacted by Brexit changes – 6%

With full border checks on EU goods entering the UK on the horizon, we asked hauliers how they’re preparing for this next change and what factors they think will have the biggest impact.

According to hauliers themselves then, bureaucracy is the biggest threat to the industry, followed by rising operating costs and COVID-19. Many are also thinking about competition coming from the EU.

Looking ahead to the start of next year, we asked UK hauliers if they foresee further issues when full customs controls on imports come into force.

Lyall Cresswell, Founder and CEO at Haulage Exchange, says:

“It’s encouraging that demand for haulage is stronger than ever, and how well companies have adapted to big changes shows the resilience of our industry. We know more changes are coming, but this is an industry used to adapting and has proved extraordinarily successful in dealing with the unexpected.

“It’s clear that haulage companies will have to continue to be flexible, especially with further Brexit changes around the corner, but this is where platforms like ours can help. Our network helps companies to avoid dead mileage or fleets sitting idle. Instead, they can take advantage of the surging demand.

“Companies can use that demand to overcome the challenges ahead and I’m positive about the future of the industry. The issues identified in our survey need to be addressed quickly and decisively. If that happens, I’m confident that the industry will continue to thrive.”

What new measures are the government proposing to help haulage companies?

On the 20th July 2021, the government announced a series of proposed measures in an attempt to resolve the shortage of haulage drivers. It was stated that they will work to encourage more people into the sector, along with improving the working conditions of current haulage drivers. The proposed measures include:

- Enabling drivers to take one test, which will allow them to drive both articulated and rigid lorries

- Looking to help improve working conditions of current drivers

- Investigating ways to improve the conditions of lorry parks

- Calling on local councils to make delivery times to retailers more flexible

- Working with the Department for Work and Pensions (DWP) to develop a new driver training pilot through JobCentre Plus.

Add-ons

Resources

Support

About

2000 - 2025. Transport Exchange Group Ltd, Reg No. 3464353 © E&OE