- How we help you

The UK Haulage Resilience Report

In 2021, we surveyed UK haulage companies on the challenges and opportunities of a post-Brexit haulage industry. In only a year since then, we’ve witnessed ongoing HGV driver shortages, new Covid-19 variants, runaway inflation and the Russia-Ukraine war.

Tristan Bacon — Updated

With various new challenges surfacing over the past year, how is the haulage industry staying resilient?

Logistics is one of the UK’s biggest industries, contributing £139 billion gross value added (GVA) to the UK economy1.

In 2021, we surveyed UK haulage companies on the challenges and opportunities of a post-Brexit haulage industry. In only a year since then, we’ve witnessed ongoing HGV driver shortages, new Covid-19 variants, runaway inflation and the Russia-Ukraine war.

All this, combined with the lasting effects of Brexit, has created new challenges for the haulage industry and the sectors that rely upon it.

As the UK’s leading freight exchange platform, we wanted to gain deeper insight into how the industry is battling through the issues it faces. We surveyed employees from 15 of the UK’s top haulage companies, who also operate in the EU. They cited Brexit impacts and other challenges – and outlined some of the solutions being applied.

Key findings

- 93% of haulage companies are still being affected by Brexit

- 4 in 5 believe volatile fuel prices are the biggest challenge UK haulage companies face in 2022 and will face 2023

- 20% have used more digital technologies to refine operations

- Nearly three-quarters (73%) have remained focused on environmental/green targets

- 40% are proactively adapting their business model to thrive

Staying resilient in the face of an economic downturn

To do business and thrive in an environment like the current one, it’s vital that haulage companies are able to adapt. Once again, haulage businesses are showing they have what it takes.

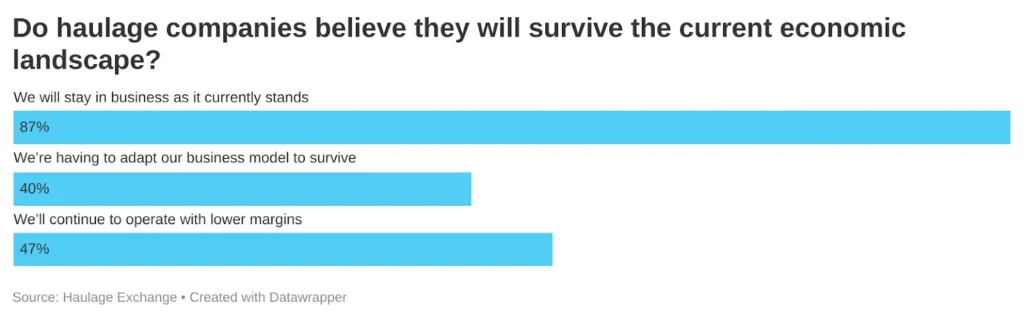

Two in five (40%) of the companies we surveyed are proactively adapting business models so that they can prosper. Almost half (47%) will streamline profit margins to battle through tougher economic times.

One in three (33%) are considering expanded operations in UK markets post-Brexit, while a fifth (20%) are already conducting more work in their local area. UK haulage companies are seeing more opportunity in the UK, shifting focus from international to less complicated domestic logistics.

As a result of the actions they’re taking, almost 9 in 10 (87%) of the haulage companies we asked believe in their ongoing commercial viability: after a challenging year, haulage companies may be becoming more confident in their ability to adapt and survive.

What are the biggest challenges in 2022 and 2023?

With numerous outside pressures building on the industry, we asked hauliers what they see posing the greatest risk to UK haulage companies this year and next year.

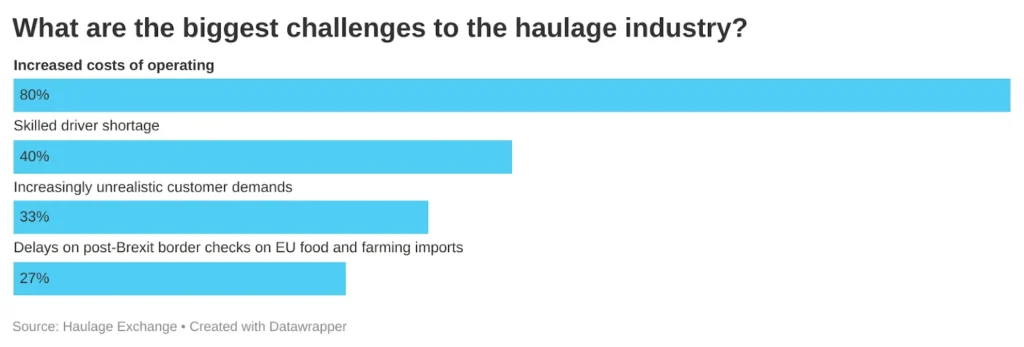

Twice as many companies cited increased operating costs as any other factor – only a fifth (20%) of businesses did not name costs as a significant issue. With a recession predicted for the UK, the focus is already falling squarely on reducing costs.

Though rising costs of operating is cited as the most prevalent challenge for the industry, haulage companies are still feeling lingering effects of Brexit – 27% are finding post-Brexit border check delays on EU food and farming imports a challenge.

What effects are hauliers currently experiencing?

Unsurprisingly, almost three-quarters (73%) of hauliers surveyed pointed to fuel prices impacting operations and profits – although prices are now coming down.

27% of companies say they are still being affected by increased waiting times at UK/EU border points, while a fifth (20%) of companies identified this as having a negative impact on operations and profits – more than 18 months after the end of the Brexit transition period. This does show an improvement compared with the 6 month mark after the Brexit transition, when 81% were being impacted by increased border waiting times.

As UK-EU relations become normalised, such issues might be less keenly felt, but hauliers are already adapting by focusing more on UK markets.

How are hauliers confronting industry challenges?

Faced with multiple and wide-ranging issues, haulage companies are seizing the opportunity to become more efficient and evolve with the changing business environment.

A fifth (20%) have increased wages to attract and retain staff, which is clearly a direct response to the driver shortage. In Q4 2021, the number of HGV drivers in employment had fallen by 49,000 from Q4 2019, to 265,000, making the workforce 15.6% smaller than it was before the start of the pandemic2.

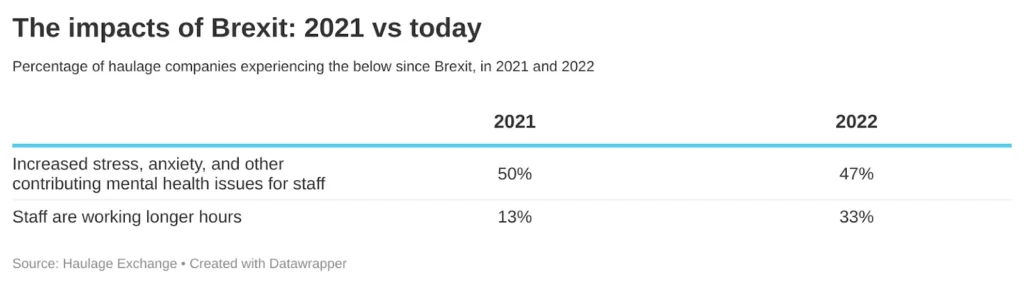

Companies are stepping up, but some pressure is still being felt by staff. Six months after the Brexit transition, 50% of respondents identified increased stress, anxiety and other mental health issues among staff. And 18 month after the Brexit transition, this has decreased only slightly, with 47% of companies still experiencing similar impacts.

Although hauliers must also tackle problems like these, raising pay is addressing one of the key grievances drivers had. And as well as lifting pay levels, companies have sought greater efficiency through updated systems, with 20% increasing their use of digital technology. While a third are seeking to enhance their bottom lines by passing rising costs onto clients.

The survey results highlight that haulage businesses have various levers they can pull to overcome obstacles – and are proactively doing so.

An industry committed to sustainability

Despite strains on the industry and 93% of companies still being affected by Brexit, 73% of haulage companies remain committed to their focus on environmental/green targets. These objectives remain a priority for the industry, especially with the government’s ‘greenprint’ to decarbonise all modes of domestic transport, including trucks, by 2050.

Some 13% of companies felt that Brexit actually drove them to increase their focus on adapting to environmental/green tech and infrastructure. Green tech is a sector where the UK has always been a leader, and the transport industry now seems intent on capitalising on this existing expertise.

The Logistics Report 2022 (by Logistics UK) also states that decarbonisation progress and the use of new/alternative fuels were both up as of 1 January 2022, when compared with the past two years.

A positive outlook ahead for haulage

While there are various pressures on the haulage industry, companies and the sector itself are taking action. To address driver shortages, for instance, even the government became involved, such is the importance of the industry.

There is now funding in place to help train new HGV drivers and, in August, it was confirmed that AEB funding for HGV driver training would be extended for a further year3. Also, between 1 January 2022 and 31 March 2022, the DVSA carried out 74% more lorry driving tests, when compared to pre-pandemic levels4.

While government measures to tackle the driver shortage and other issues are very welcome, it’s clear that longer term planning is also needed and lines of communication between government and the industry must stay open. If all parties involved can continue to work together, haulage can keep moving throughout the uncertain times ahead.

Azad Awan, Sales Manager at Haulage Exchange, says:

“There’s no doubt that the haulage industry has experienced quite a few challenges in the past year – and will face more obstacles in the coming months. But the industry has dealt with everything thrown at it, and will continue to do so. It’s proved itself to be more than resilient.

“This survey highlights how hauliers are looking ahead and already planning how to mitigate potential problems. It’s only natural that when margins are tight and efficiency is called for, businesses turn to technology to provide answers.

“That’s what we’re all about: helping companies do business smoothly and giving them space to grow. If more companies can build time-saving digital solutions into their everyday routines, it will only benefit the industry as a whole.”

References

- The Logistics Report Summary 2022, p.5, Logistics UK

- The Logistics Report Summary 2022, p.9, Logistics UK

- https://www.gov.uk/government/publications/adult-education-budget-aeb-funding-rules-2022-to-2023/adult-education-budget-aeb-funding-rules-2022-to-2023#heavy-goods-vehicle-hgv-driver-training

- https://www.gov.uk/government/news/huge-increase-in-lorry-driving-tests-following-government-action

Add-ons

Resources

Support

About

2000 - 2025. Transport Exchange Group Ltd, Reg No. 3464353 © E&OE