When goods move across borders, there’s one unavoidable step that stands between the shipment and the customer: customs clearance. Without it, international trade would grind to a halt.

In this guide, we’ll explain the custom clearance meaning, how the process works, and how to avoid the most common issues that can stall your shipments.

What we’ll cover

Fleets, bookings, subcontractors, compliance & payments.

With HX, you can manage them all in one place.

What is customs clearance and customs cleared status?

Before goods can legally enter or leave a country, they need to pass through customs. This is the point where government officials check that your shipment complies with all regulations, and that the right taxes and duties are paid.

When a shipment successfully completes this process, it’s given customs cleared status.

So, what is customs clearance exactly? In simple terms, it’s the government’s way of managing imports and exports to ensure safety, correct paperwork, and proper revenue collection.

Without clearance, goods are held at the border until issues are resolved, which can cause major delays.

In practice, custom clearance means two things: clearing the paperwork, and physically clearing the goods for onward travel.

Once these two steps are complete, goods can continue to their final destination, whether that’s a bonded warehouse, shop, or directly to a consumer.

The three steps of customs clearance explained

Customs clearance isn’t one single action, but rather a short series of steps that take place every time goods cross borders. Understanding these stages can help you avoid costly mistakes and unnecessary delays.

Let’s break down each phase in detail.

1. Document submission and inspection

The first step is submitting your paperwork to the relevant customs authority. This includes commercial invoices, shipping documents, licences, permits, and any certificates of origin or product compliance.

The customs team will check these documents to verify the shipment’s contents, value, and legal compliance.

In some cases, customs officers may request to physically inspect the goods. Random checks, inconsistencies in paperwork, or concerns over banned or restricted items can all trigger inspections.

Accurate paperwork greatly reduces the chances of these inspections causing delays.

Documentation is often managed by specialist freight forwarders, who act as intermediaries between shippers and customs authorities.

They handle complex declarations, helping to minimise clearance time and prevent paperwork errors.

2. Duty and tax calculation process

Once documents are approved, customs officials calculate the taxes and duties owed. This is based on the shipment’s declared value, tariff classification, country of origin, and any applicable trade agreements.

Getting these figures wrong can lead to overpayment, underpayment, or even fines.

For many UK importers, this stage includes paying import tax and customs duties, which are two separate charges.

Import duty is applied based on the nature of the goods, while VAT is charged on the total value of the shipment including duty and transport costs.

The more accurate your product information, the smoother this stage becomes.

Misclassification of goods is a common problem that can trigger reassessments or audits down the line. Naturally, that’s something you want to avoid.

3. Payment and release of goods

Once taxes and duties are paid, customs issues release authorisation for the shipment. The goods are then cleared for delivery to their final address.

Any unpaid charges or unresolved issues will keep the shipment in customs hold until resolved.

Many companies use freight forwarding companies to handle payment and release on their behalf. Why? These providers often have dedicated clearance teams who stay in direct contact with customs authorities, expediting release times.

At this point, the shipment status may update to customs clearance completed on the carrier’s tracking system. This means customs procedures are finished and goods are now in the hands of the domestic delivery network.

HS codes and customs declaration essentials

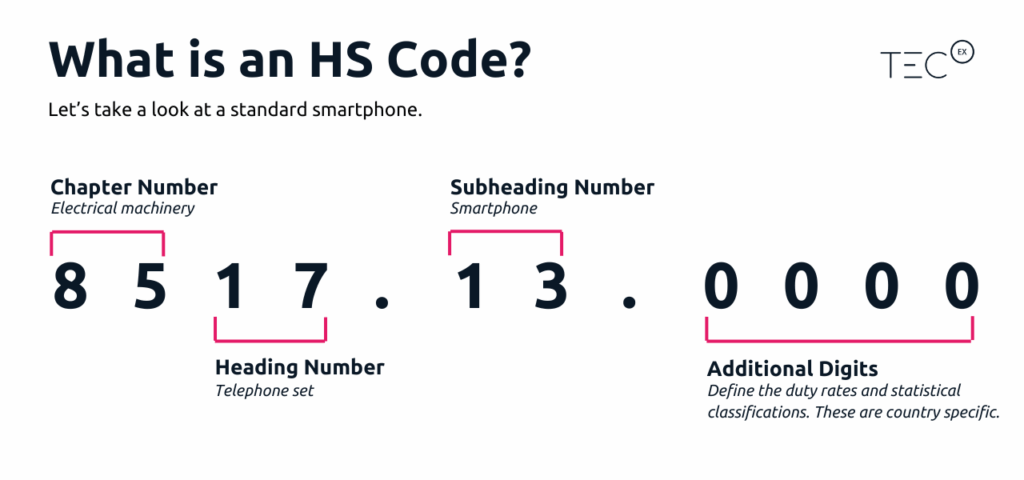

A large part of customs clearance revolves around HS codes and customs declarations.

HS codes, which stands for Harmonised System codes, are international product classifications used by nearly every country to categorise goods.

Each product type is assigned a code, which customs authorities use to determine duty rates, import restrictions, and licensing requirements.

For example, importing textiles uses a different code from importing electronics or food products. You can check out HMRC’s guide to HS codes here.

When completing your customs declaration, selecting the correct HS code is important because an incorrect code can lead to the wrong duty being applied or even seizure of goods.

Declarations must also include accurate product descriptions, values, weight, and country of origin.

Who pays and who manages customs clearance?

One of the most common questions in international trade is: who’s responsible for customs clearance?

The answer depends on your Incoterms agreement (whether the buyer or seller is managing logistics and paying fees). In many business-to-business transactions, the buyer arranges clearance and pays all duties upon arrival.

In consumer e-commerce, sellers often include duties in the total purchase price through Delivered Duty Paid arrangements.

Custom clearance meaning includes not only the legal process but also the financial obligations attached. If payment isn’t made promptly, customs may hold or seize the shipment, adding storage fees.

Many businesses outsource the process to specialist customs brokers or freight forwarders. Their expertise reduces costly mistakes and accelerates clearance times.

This approach also ensures compliance with ever-changing global trade rules.

How to calculate import duties and clearance fees

Knowing how to calculate your charges ahead of time can prevent surprises at customs.

The calculation starts with your shipment’s declared value – the total paid for the goods, excluding shipping and insurance. Customs then adds any applicable import tax and customs duties.

The duty percentage is based on the:

- HS code

- Product type

- Country of origin

What about trade agreements, such as those with the EU or Commonwealth countries? Well, they may reduce or eliminate duties on certain products.

Next, VAT is calculated on the sum of goods value, duty, shipping, and insurance.

For most UK imports, the standard VAT rate is currently 20%, though some items qualify for reduced rates or exemptions.

Finally, some shipments may face clearance fees charged by freight handlers or courier companies. These service fees cover the admin work involved in processing customs declarations.

Reliefs, exemptions, and low-value thresholds

Not every shipment is subject to full duties and taxes. The UK offers several reliefs and exemptions that reduce costs for qualifying importers.

One example is Inward Processing Relief, allowing businesses to import goods for manufacturing or repair without duty, provided the items are re-exported.

Outward Processing Relief offers similar benefits for goods temporarily exported for processing. Personal gifts and low-value shipments may also benefit from de minimis thresholds.

Currently, many goods valued under £135 may be exempt from import duty but may still attract VAT. Understanding these schemes is an important part of managing import costs effectively.

Businesses that regularly import should explore all available reliefs with their customs broker or freight agent. Taking advantage of reliefs can create substantial long-term savings.

Top reasons customs clearance stalls

Despite best efforts, some shipments still encounter clearance delays. One of the most frequent causes is incomplete or inaccurate paperwork, especially around product descriptions and values.

Mismatched HS codes can also flag a shipment for manual inspection.

Customs officers may pause clearance while they investigate discrepancies or request additional documents.

Payment issues are another common problem that triggers holds. If duties or taxes aren’t settled promptly, customs will hold the shipment until payment clears.

Storage fees may be added daily while the goods sit in customs. Over time, these charges can add up to considerable extra costs.

Resolving issues quickly prevents unnecessary delays and expenses.

Common customs clearance mistakes to avoid

Even with the right paperwork, customs clearance can easily go wrong. Some mistakes are far more common than others, and avoiding them can save both time and money.

Here are the main things to watch out for:

- Incorrect HS codes: Misclassifying goods leads to overpaying duties or facing penalties for underpayment. Always verify codes using the latest UK tariff schedules.

- Wrong declared value: Declaring the incorrect commercial value triggers audits or fines. Customs will question invoices that seem unusually low for the goods.

- Missing documentation: Licences, permits, and certificates of origin may all be required depending on the goods. Submitting these late delays clearance.

- Restricted or prohibited items: Some goods require special permissions or cannot be imported at all. Failing to check restrictions leads to holds or confiscation.

- Poor communication between parties: Confusion between importers, brokers, and freight forwarders causes unnecessary clearance delays. Clear coordination avoids errors and holds.

Tips for efficient and cost-effective clearance

Good preparation is the best way to ensure fast, trouble-free customs clearance. Start by reviewing the customs requirements for each destination country before arranging shipments.

Each country may have its own regulations for restricted or controlled goods.

Here are some simple ways to avoid delays and extra costs:

- Work with trusted freight forwarders who handle complex declarations daily and stay up to date with regulations.

- Double-check that all invoices, permits, licences, and certificates of origin are complete and accurate.

- Keep clear, organised records for every shipment to make audits or compliance checks easier.

- Pay duties, VAT, and fees promptly to avoid shipments being held in customs storage.

- Communicate regularly with your freight forwarder or broker to stay updated if any issues arise.

The role of freight forwarders in customs clearance

For many importers, freight forwarders are essential partners in navigating customs clearance. They act as intermediaries, taking over much of the complex paperwork and coordination involved.

This allows businesses to focus on operations while leaving the compliance side to specialists. Freight forwarders stay up to date on changing regulations, both in the UK and internationally.

They know how to correctly classify goods, apply trade agreements, and handle duty calculations. This expertise helps avoid costly mistakes that could delay clearance or trigger inspections.

Many forwarders offer full customs brokerage services, managing documentation, duty payments, and even communication with customs officers. For businesses new to international trade, this support is invaluable.

You can use freight forwarding platforms to find trusted forwarders who specialise in UK customs processes to simplify your import operations. As your business grows, forwarders also help manage larger, more complex supply chains. Whether you’re looking to grow your freight forwarding company or simply need reliable support, having an expert handle customs clearance can save both time and money.

How Brexit changed UK customs clearance

Brexit has brought lasting changes to how customs clearance works for UK businesses.

Before 2021, most trade with the EU moved freely without much paperwork. Now, nearly all shipments between the UK and EU face full customs controls.

Importers and exporters must now submit customs declarations for goods crossing the border. This includes providing HS codes, certificates of origin, and detailed product descriptions for every shipment.

Without the correct paperwork, EU-bound shipments may be refused entry or delayed at the border.

UK businesses trading with Europe must also apply for an Economic Operator Registration and Identification number.

This unique ID is now required for nearly all customs activities. Applying early prevents administrative delays when arranging shipments.

Delays at border control points have become more common, particularly during busy periods and with the new EU Entry/Exit System implemented in October 2025. Proper customs preparation is now vital when dealing with both EU and non-EU partners.

Working with experienced freight forwarders can help businesses adjust to these ongoing regulatory changes.

Customs clearance FAQs

What does it mean if my package is in customs clearance?

It means your goods are being reviewed by customs to verify paperwork, calculate duties, and ensure legal compliance. Once approved and paid, they’ll move to domestic delivery. This is a normal stage of international shipping.

What is the meaning of customs clearance?

The custom clearances means the legal process where imported goods are inspected, taxed, and approved by customs officials before release. Without clearance, shipments can’t enter the country. This applies to both personal and commercial imports.

How long does customs clearance take?

Most shipments clear within a few hours to a few days if documents are correct. Delays may occur for inspections, payment issues, or incorrect paperwork. Using professional clearance agents often speeds up the process.

What happens after customs clearance?

Once customs clearance completed status is reached, your goods are released for final delivery. Domestic couriers or freight handlers take over from customs. The shipment is then delivered to its end recipient.