- How we help you

What is a UK tariff code?

A clear guide to using UK tariff codes, with tips for hauliers on classification, HS system methods, and avoiding common mistakes.

Tristan Bacon — Published

A UK tariff code is a unique number assigned to products that helps classify them for customs purposes, ensuring that the right taxes, duties, and fees are applied.

In this guide, we’ll explain everything you need to know about UK tariff codes, from why they matter to how you can easily find a tariff code. If you’re new to the world of importing and exporting or if you’re starting a haulage company, we’ve got you covered with clear and straightforward info to get you on track.

What we’ll cover

Why tariff codes matter for trade

Tariff codes are the backbone of international trade; without them, customs wouldn’t know what your goods are, what duties to charge, or if your goods need special permits.

If you get your tariff code wrong, you could face delays, problems with customs clearance, or get charged the wrong amount. That means paying too much or, even worse, not getting your goods through at all.

If you want to avoid mistakes like that, your first move is finding a tariff code that fits your product properly and lines up with how duties are applied (this ties closely to how import tax and customs duties are worked out in the UK).

Once you’ve got the right UK tariff code, your goods move through the system more smoothly, and you’re not caught off guard by extra costs or admin.

Understanding the harmonised system (HS)

The Harmonised System (HS) is a globally standardised way of classifying goods. It forms the foundation for tariff codes used around the world, including in the UK.

Every product traded internationally is assigned an HS code, which helps customs authorities identify what the item is, apply the correct duties, and monitor trade statistics.

HS codes are recognised in over 200 countries and used by more than 98% of international trade. So, getting familiar with the HS system is key if you want your goods to move across borders without issues.

HS code format and UK commodity code details

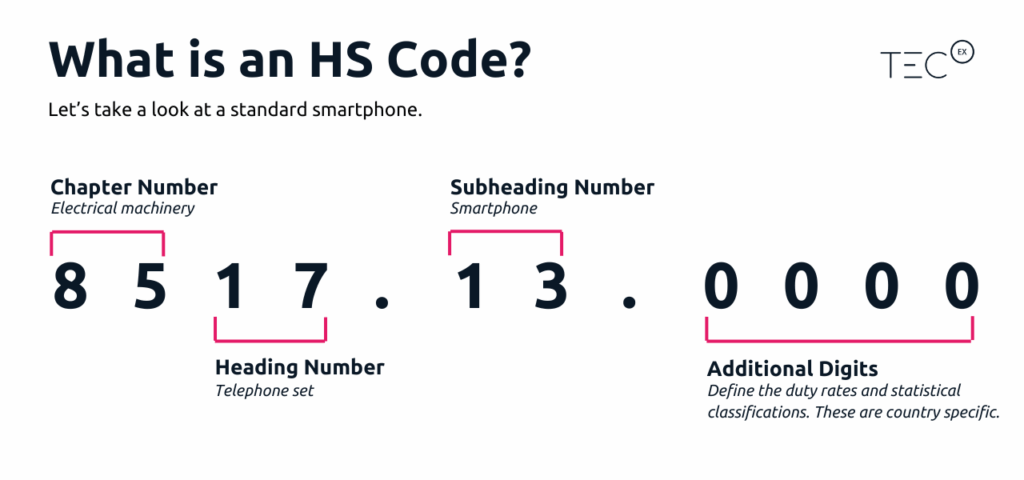

The HS code is always six digits long. The first two digits show the broader category of the product, while the next four digits narrow it down.

In the UK, the code is extended by another four digits to make a total of ten digits. This extra detail helps classify the product even more precisely for customs.

Let’s take an example: imagine you’re importing shoes. The HS code for footwear could be something like 6403, which would tell customs that it’s a particular type of shoe.

But the UK might add extra digits (say 6403 91 10) which would give even more info about the material and purpose of the shoes. This is where you can see the difference between the HS code and the commodity code, as the latter is more specific to the UK.

Main methods for finding tariff codes

Finding the right UK tariff code doesn’t have to be hard, but it does depend on the type of goods you’re working with. Below, we’ll go through some easy ways you can find a tariff code and get your products moving through customs without any hassle.

Let’s break it down and look at the different methods you can use to get the code you need for your goods. First off:

Option 1: Use the UK trade tariff online tool

One of the easiest ways to find a tariff code is by using the UK trade tariff online tool. This free tool lets you search for your product and quickly pull up the right code.

All you need to do is type in a description of your product! Then, the tool will give you the UK tariff code based on that.

It’s really straightforward to use, and it’s the first place you should go when you’re trying to figure out which code fits your product. If you’ve got a basic understanding of your goods, this tool can help you narrow down your options in no time.

Option 2: Email HMRC classification enquiries

If the online tool doesn’t cut it, or if you’re dealing with a more complex product, you can email HMRC for a classification enquiry.

HMRC will help you figure out the right tariff code based on a more detailed description of your goods.

While this might take a bit longer than using the online tool, it’s a great way to get certainty when you’re unsure about where your product falls in the tariff system. Freight forwarders also often have experience dealing with HMRC and can help you get the correct classification for your product.

Option 3: Search via sections, chapters, or A-Z index

Another way to find a tariff code is by browsing through the UK tariff book, either via sections or chapters. This allows you to see how different products are classified based on their type or function.

The A-Z index can also be helpful for a quick look-up. While this method is a little more manual, it can give you a solid understanding of where your product fits in the tariff system and help you find the right code without relying on the online tool.

Option 4: Obtain an advance tariff ruling (ATR / ATI)

If you’re still not sure which tariff code applies, you can request an advance tariff ruling (ATR) from HMRC. This means you’ll submit your product details, and HMRC will officially tell you which code applies.

This is particularly useful if you’re dealing with a complex or unusual product. Once you’ve got your ATR, you’ll know exactly how your goods should be classified, giving you peace of mind when it comes to customs clearance.

Extra code types and declaration rules

In addition to the regular UK tariff codes, there are a few extra code types that apply in specific situations. These are typically for goods that fall under quotas, suspensions, or are exempt from VAT, and they require special tariff codes.

If your product is one of these, it’s important to use the correct code to avoid any issues with taxes or customs. When it comes to trade, getting the small details right is paramount, so don’t overlook these extra rules.

Combined nomenclature, TARIC and national extensions

The combined nomenclature (CN) and TARIC systems are used to classify goods in the EU. Parts of these systems still apply in the UK, especially for goods moving between the UK and EU.

These systems use extra digits to give more detail about products, especially for those subject to quotas or special duties.

In addition, the UK has its own national extensions that provide even more precise classifications. These are added on top of the HS and CN codes to provide clarity for goods with unique characteristics or special treatment.

Applying codes for quotas, suspensions, and VAT

Certain goods fall under special rules, such as quotas, suspensions, or VAT exemptions. For these items, you’ll need to apply specific codes to make sure you’re meeting the regulations.

For example, some products might be exempt from certain duties if they’re classified under specific quotas or suspensions.

To keep things running smoothly, always double-check whether your product falls under these special classifications, especially if you’re dealing with large haulage businesses that regularly handle this kind of trade.

Common errors and how to avoid them

- Using vague product descriptions: If your product description is too broad or unclear, you might land on the wrong code. Be as specific as possible when describing materials, use, and features.

- Relying on outdated codes: Tariff codes can change from year to year. Always check the most recent version of the UK trade tariff tool before filing any customs paperwork.

- Missing extra classification rules: Some goods require special codes for things like VAT relief, quotas, or suspended duties. Skipping these can result in delays or paying more than necessary.

- Stopping at the 6-digit HS code: The full UK code is ten digits, not six. If you don’t include the full code, your goods may not be processed correctly.

- Copying another company’s code: Just because a similar product uses a certain code doesn’t mean it applies to yours. Even small differences in material, design, or purpose can change the classification.

- Guessing instead of checking: Taking a shot in the dark to save time can lead to bigger issues later. If you’re unsure, contact HMRC for advice or use a freight exchange platform to connect with professionals who know the system inside out.

- Not updating the code when the product changes: If your product’s materials, use, or specs change, the tariff code might too. Always review the code whenever something about the product shifts.

Find reliable carriers and cut your costs with Haulage Exchange

Sign upTariff code FAQs

What’s the difference between HS and commodity codes?

The HS code is used worldwide for classifying products, while the commodity code is specific to each country, such as the UK. The UK’s commodity code extends the HS code, providing more detail about the product.

Can I use an overseas HS code in the UK?

Not always. The UK may require additional digits or modifications to the overseas HS code to meet national requirements. It’s a good idea to verify the code before using it in the UK.

Where can I find tariff information?

Tariff information is available through the UK trade tariff online tool or from HMRC. This tool makes it easy to find the right tariff code for your goods.

Who provides tariff codes?

Tariff codes are provided by HMRC, the UK’s customs authority. You can access these codes via the online tool or contact HMRC for further assistance.

Why do I need a tariff code?

You need a UK tariff code to determine the correct taxes, duties, and compliance requirements for your goods. It helps guarantee that your goods clear customs without issues and that you’re not overcharged or fined.

When your fleet takes on high-risk freight, the stakes go up. You’re dealing with loads that may be fragile, high-value, dangerous, or tightly regulated. That means more planning, more paperwork, and a bigger focus on safety.

Let’s take a closer look at what counts as high-risk freight, the rules that apply, and how haulage businesses can handle these loads confidently.

What we’ll cover

Understanding what qualifies as high-risk freight

Not every load needs special handling. But when it does, you’ll know about it—usually before you’ve even accepted the job. So, what kind of cargo falls into the high-risk freight category?

Common types of high-risk loads

Some goods come with obvious risks. Others need a second look. Here are the most common types of high-risk freight seen across UK fleets:

- High-value cargo like electronics, pharmaceuticals, or jewellery

- Sensitive goods such as confidential documents, medical specimens, or secure data storage

- Fragile items, including glass, ceramics, and precision equipment

- Cold chain logistics goods like chilled or frozen food, often time-sensitive

- Hazardous freight, including flammable, toxic, or explosive materials

The more risks a load presents—whether physical, environmental, or legal—the more planning it demands.

What makes a load high risk?

There’s no single definition, but most haulage and logistics businesses use a mix of factors to flag a load as high risk:

- Theft potential: High-value goods are more likely to attract attention for cargo theft

- Safety concerns: Hazardous goods transport poses extra danger to drivers and the public

- Fragility or spoilage: Some goods are easily damaged or perishable

- Legal rules: ADR haulage or security requirements increase handling complexity

Understanding these risks helps your fleet management team match the right vehicle and driver to each job.

Licences and certifications to be aware of

High-risk loads often come with legal strings attached. That might mean extra paperwork, specialised training, or tighter load control.

ADR and DGSA responsibilities

If your fleet carries hazardous freight, you’ll likely need ADR compliance. ADR refers to international rules for road transport of dangerous goods.

Drivers moving dangerous goods must hold an ADR certificate. This covers both theoretical knowledge and practical handling.

You may also need a DGSA (Dangerous Goods Safety Adviser). Their job is to help your business stay compliant, carry out audits, and offer advice on safe loading and handling practices. Regular reporting is also part of their role.

Adding ADR haulage to your services brings in new business, but it also adds responsibilities. Make sure your internal processes reflect that.

Fleet-level compliance

Your vehicles and trailers must meet specific standards if they’re carrying dangerous or sensitive loads. This includes:

- Proper labelling and hazard signage

- Onboard safety equipment (fire extinguishers, spill kits, etc.)

- Emergency instructions for the driver

- Correct documentation in the cab at all times

Having a certified transport manager who understands these rules helps reduce mistakes.

Best practices for handling hazardous cargo

Once the right paperwork is in place, your drivers still need practical support to handle hazardous cargo properly.

Preparation before the journey is as important as the delivery itself.

- Check load weight and securing methods carefully

- Fit the correct hazard signs and carry documentation in an accessible format

- Provide PPE suited to the goods (e.g. gloves, goggles, spill masks)

- Use temperature monitoring for goods that need it

- Pre-plan routes to avoid tunnels or restrictions

All of this helps your team manage hazardous cargo handling without delays or safety issues.

The role of your transport and fleet managers

Your transport manager and fleet manager sit at the heart of your risk-handling strategy. They’re not just ticking boxes—they’re helping the business avoid costly issues on the road.

Their tasks include:

- Assigning trained drivers to high-risk jobs

- Keep on top of haulage insurance to ensure full coverage

- Monitoring telematics and trailer sensors

- Verifying all load documentation before dispatch

- Adjusting route plans around weather, traffic or restrictions

- Logging delivery times and offload checks

A proactive manager can spot small problems before they grow into bigger ones. They also help build trust with clients moving sensitive freight.

Ongoing training for high-risk freight drivers

Moving high-risk freight isn’t just about paperwork. Your drivers need regular training to stay sharp, especially when it comes to hazardous goods transport and sensitive goods.

Keeping driver skills current

It’s tempting to see training as a one-off. But refresher sessions matter—especially if your fleet is handling dangerous or fragile loads regularly.

Options include:

- On-site briefings from your safety officer or DGSA

- Accredited ADR refresher courses (every 5 years)

- Digital microlearning for specific goods types

- Emergency drill run-throughs at depots

Build this into your routine driver risk assessments so nothing gets overlooked.

Don’t forget that some cargo types may also require a cargo operative certification, particularly if working around airside or bonded warehouse facilities.

Find reliable carriers and cut your costs with Haulage Exchange

Sign upHigh-risk freight FAQs

What qualifies as high-risk freight?

High-risk freight includes anything that requires extra care during transport. That might be due to theft risk, fragility, perishability, or legal restrictions. Common examples include electronics, chemicals, pharmaceuticals, and sensitive data items.

Do I need ADR for all hazardous goods transport?

Not always. ADR rules only apply if your load contains goods above specific thresholds. For example, small amounts of certain chemicals may be exempt. Always check the UN class of the substance and consult your DGSA.

What is a DGSA and do I need one?

A DGSA (Dangerous Goods Safety Adviser) helps you manage safety and compliance when moving dangerous goods. If your business handles these loads regularly, you’re legally required to appoint one. They review policies, check routes, and conduct internal audits.

How often should drivers be trained on sensitive freight?

At least once a year. This can be a formal course or in-house safety briefings. The more complex or dangerous the goods, the more regular training should be.

Who is responsible for hazardous freight compliance?

It’s a shared effort. The transport manager oversees scheduling and compliance. The driver follows procedures on the road. Your fleet management team supports both with tools, training, and documentation.

When you’re driving a heavy goods vehicle (HGV) in the UK, speed restrictions aren’t just guidelines, they’re legal requirements made to protect everyone on the road.

HGV speed restrictions vary depending on road type, vehicle weight, and sometimes even your load. In this guide, we’ll break down the current rules, cover penalties, and share some best practices to help you stay safe and legal.

What we’ll cover

National speed limits for HGVs and LGVs

HGVs and LGVs each fall under different speed regulations depending on weight and road type. HGVs are vehicles with a maximum authorised mass (MAM) over 3.5 tonnes, while LGVs are anything at or below that threshold.

If you’re still working out the correct vehicle class for your business, our guide on lorry sizes and UK regulations offers a detailed breakdown of weight categories, axle configurations, and legal definitions.

These LGV and HGV speed restrictions aren’t just random numbers; they’re based on years of data about stopping distances, vehicle stability, and accident risks.

Heavier vehicles take much longer to slow down and are harder to control at higher speeds. For example, according to UK parliamentary research, a fully loaded 42-tonne HGV has a total stopping distance of around 36 metres at 30 mph, compared to 23 metres for a car (and the gap widens sharply at motorway speeds).

HGV speed limit on single carriageways

Single carriageways are often the trickiest roads for large lorries due to narrow lanes, bends, and mixed traffic. The national HGV speed restrictions for vehicles over 7.5 tonnes on single carriageways is 50 mph.

This change was implemented back in 2015 to improve safety and reduce dangerous overtaking on rural roads.

HGV speed limit on dual carriageways

Dual carriageways offer two lanes in each direction, making it easier for larger vehicles to maintain steady speeds.

The speed limit for HGV on dual carriageway roads is set at 60 mph for vehicles over 7.5 tonnes. Even with the extra space, drivers need to stay alert for changing traffic conditions and signage.

LGV speed limit on dual carriageways

Light goods vehicles have slightly more freedom when it comes to dual carriageways.

The speed limit for car-derived vans on dual carriageway routes is typically 70 mph if not towing. However, if towing a trailer, the limit drops to 60 mph to maintain stability and safety.

HGV motorway speed limits

Motorways are the safest roads for long-distance freight thanks to controlled access and multiple lanes.

The HGV motorway speed limit for vehicles over 7.5 tonnes is 60 mph. This limit balances travel efficiency with the need for longer braking distances and safe manoeuvring.

For many drivers working in a freight exchange network, motorways make up a large part of daily operations. The smoother flow of motorway driving helps keep schedules on track and cargo moving efficiently across the country.

Speed limit for HGVs with trailers and articulated rigs

Whether you’re driving a rigid lorry with a trailer or a full articulated rig, the speed limit remains 60 mph on motorways. Articulated vehicles make up a large portion of UK freight traffic, so these limits apply to many haulage operators.

Drivers must remain aware of their vehicle’s length, especially when overtaking or changing lanes.

LGV motorway speed limit guidelines

LGVs can usually follow the same motorway speed limits as standard passenger vehicles. This means 70 mph is allowed for LGVs not towing trailers.

However, it’s important to note that this 70 mph limit is not universally applicable. It applies only to car-derived vans. Larger vans (up to 3.5 tonnes) that are not car-derived must stick to 60 mph on dual carriageways, even if they’re not towing.

If towing, the limit reduces to 60 mph for all LGVs, keeping in line with stability concerns and legal requirements.

Mandatory speed limiter regulations for HGVs

Speed limiters are mandatory on most HGVs to help enforce safe driving speeds.

For vehicles over 7.5 tonnes, the limiter restricts the top speed to 56 mph, slightly below the legal motorway limit. This buffer accounts for variations like gradients, wind resistance, and tyre conditions.

If you operate a large haulage business, maintaining these devices is a legal obligation.

The same applies whether you run a single lorry or manage a small haulage business. Regular maintenance helps avoid penalties and keeps your drivers safe on the road.

Local and urban speed limit variations

Once you enter built-up areas, speed limits tighten considerably. Both HGVs and LGVs must stick to 30 mph in towns and cities unless otherwise posted.

Many local authorities also apply 20 mph zones near schools, residential areas, and high pedestrian zones for extra safety.

Local councils may introduce temporary restrictions for construction or special events. Always check for signage indicating lower limits or roadworks. Ignoring these temporary limits could result in fines and penalty points.

Even if you’re driving in familiar areas, road layouts and limits can change frequently. Keeping up to date ensures you don’t fall foul of unexpected restrictions.

Staying alert helps protect pedestrians, cyclists, and other vulnerable people using the road.

Penalties and enforcement for HGV speeding

Ignoring HGV speed restrictions carries stiff penalties that affect both drivers and operators. Offenders face fines, penalty points, and possible disqualification depending on the severity of the offence.

If you’re thinking of starting a transport company, understanding these regulations early on is key to staying compliant from day one.

For companies, repeated offences can threaten the Operator’s Licence, potentially shutting down business operations. Even minor infringements add up quickly if not addressed.

Compliance isn’t just about following rules; it protects your business long-term.

Tachograph data provides clear evidence of speed compliance during audits and inspections. Ensuring your fleet operates within legal limits keeps your records clean.

Prevention is always better than arguing your case in front of a Traffic Commissioner.

Best practices for safe driving near HGVs

It’s not just drivers of HGVs who need to understand the rules. Other road users should give lorries space, especially when overtaking or merging.

If you can’t see the lorry’s mirrors, assume the driver can’t see you either.

Cutting in too sharply after overtaking can create dangerous situations. Large vehicles need extra time and distance to stop safely.

Giving HGVs plenty of space benefits everyone sharing the road.

Remember that even fully loaded lorries still need to navigate tight junctions and roundabouts. Be patient when following or approaching one in built-up areas.

A little extra caution helps everyone get home safely.

Find reliable carriers and cut your costs with Haulage Exchange

Sign upFrequently asked questions

What speed can an HGV do on a dual carriageway?

The dual carriageway speed limit for HGVs over 7.5 tonnes is 60 mph. This applies whether fully loaded or empty. Always watch for local speed signs that may override national limits.

What is the maximum speed limit on highway for lorries?

On UK motorways, the maximum legal speed for HGVs over 7.5 tonnes is 60 mph. For LGVs not towing, the limit rises to 70 mph. Towing reduces LGV limits to 60 mph.

Can HGV do 60mph?

Yes, HGVs can legally travel at 60 mph on dual carriageways and motorways. However, many vehicles are restricted to 56 mph by mandatory speed limiters. This helps improve road safety and fuel efficiency.

What is the max speed for dual carriageway?

For HGVs over 7.5 tonnes, the dual carriageway speed limit is capped at 60 mph. LGVs may drive up to 70 mph unless towing, in which case it’s 60 mph. Always follow posted signs for local variations.

When goods move across borders, there’s one unavoidable step that stands between the shipment and the customer: customs clearance. Without it, international trade would grind to a halt.

In this guide, we’ll explain the custom clearance meaning, how the process works, and how to avoid the most common issues that can stall your shipments.

What we’ll cover

What is customs clearance and customs cleared status?

Before goods can legally enter or leave a country, they need to pass through customs. This is the point where government officials check that your shipment complies with all regulations, and that the right taxes and duties are paid.

When a shipment successfully completes this process, it’s given customs cleared status.

So, what is customs clearance exactly? In simple terms, it’s the government’s way of managing imports and exports to ensure safety, correct paperwork, and proper revenue collection.

Without clearance, goods are held at the border until issues are resolved, which can cause major delays.

In practice, custom clearance means two things: clearing the paperwork, and physically clearing the goods for onward travel.

Once these two steps are complete, goods can continue to their final destination, whether that’s a bonded warehouse, shop, or directly to a consumer.

The three steps of customs clearance explained

Customs clearance isn’t one single action, but rather a short series of steps that take place every time goods cross borders. Understanding these stages can help you avoid costly mistakes and unnecessary delays.

Let’s break down each phase in detail.

1. Document submission and inspection

The first step is submitting your paperwork to the relevant customs authority. This includes commercial invoices, shipping documents, licences, permits, and any certificates of origin or product compliance.

The customs team will check these documents to verify the shipment’s contents, value, and legal compliance.

In some cases, customs officers may request to physically inspect the goods. Random checks, inconsistencies in paperwork, or concerns over banned or restricted items can all trigger inspections.

Accurate paperwork greatly reduces the chances of these inspections causing delays.

Documentation is often managed by specialist freight forwarders, who act as intermediaries between shippers and customs authorities.

They handle complex declarations, helping to minimise clearance time and prevent paperwork errors.

2. Duty and tax calculation process

Once documents are approved, customs officials calculate the taxes and duties owed. This is based on the shipment’s declared value, tariff classification, country of origin, and any applicable trade agreements.

Getting these figures wrong can lead to overpayment, underpayment, or even fines.

For many UK importers, this stage includes paying import tax and customs duties, which are two separate charges.

Import duty is applied based on the nature of the goods, while VAT is charged on the total value of the shipment including duty and transport costs.

The more accurate your product information, the smoother this stage becomes.

Misclassification of goods is a common problem that can trigger reassessments or audits down the line. Naturally, that’s something you want to avoid.

3. Payment and release of goods

Once taxes and duties are paid, customs issues release authorisation for the shipment. The goods are then cleared for delivery to their final address.

Any unpaid charges or unresolved issues will keep the shipment in customs hold until resolved.

Many companies use freight forwarding companies to handle payment and release on their behalf. Why? These providers often have dedicated clearance teams who stay in direct contact with customs authorities, expediting release times.

At this point, the shipment status may update to customs clearance completed on the carrier’s tracking system. This means customs procedures are finished and goods are now in the hands of the domestic delivery network.

HS codes and customs declaration essentials

A large part of customs clearance revolves around HS codes and customs declarations.

HS codes, which stands for Harmonised System codes, are international product classifications used by nearly every country to categorise goods.

Each product type is assigned a code, which customs authorities use to determine duty rates, import restrictions, and licensing requirements.

Credit: TecEx For example, importing textiles uses a different code from importing electronics or food products. You can check out HMRC’s guide to HS codes here.

When completing your customs declaration, selecting the correct HS code is important because an incorrect code can lead to the wrong duty being applied or even seizure of goods.

Declarations must also include accurate product descriptions, values, weight, and country of origin.

Who pays and who manages customs clearance?

One of the most common questions in international trade is: who’s responsible for customs clearance?

The answer depends on your Incoterms agreement (whether the buyer or seller is managing logistics and paying fees). In many business-to-business transactions, the buyer arranges clearance and pays all duties upon arrival.

In consumer e-commerce, sellers often include duties in the total purchase price through Delivered Duty Paid arrangements.

Custom clearance meaning includes not only the legal process but also the financial obligations attached. If payment isn’t made promptly, customs may hold or seize the shipment, adding storage fees.

Many businesses outsource the process to specialist customs brokers or freight forwarders. Their expertise reduces costly mistakes and accelerates clearance times.

This approach also ensures compliance with ever-changing global trade rules.

How to calculate import duties and clearance fees

Knowing how to calculate your charges ahead of time can prevent surprises at customs.

The calculation starts with your shipment’s declared value – the total paid for the goods, excluding shipping and insurance. Customs then adds any applicable import tax and customs duties.

The duty percentage is based on the:

- HS code

- Product type

- Country of origin

What about trade agreements, such as those with the EU or Commonwealth countries? Well, they may reduce or eliminate duties on certain products.

Next, VAT is calculated on the sum of goods value, duty, shipping, and insurance.

For most UK imports, the standard VAT rate is currently 20%, though some items qualify for reduced rates or exemptions.

Finally, some shipments may face clearance fees charged by freight handlers or courier companies. These service fees cover the admin work involved in processing customs declarations.

Reliefs, exemptions, and low-value thresholds

Not every shipment is subject to full duties and taxes. The UK offers several reliefs and exemptions that reduce costs for qualifying importers.

One example is Inward Processing Relief, allowing businesses to import goods for manufacturing or repair without duty, provided the items are re-exported.

Outward Processing Relief offers similar benefits for goods temporarily exported for processing. Personal gifts and low-value shipments may also benefit from de minimis thresholds.

Currently, many goods valued under £135 may be exempt from import duty but may still attract VAT. Understanding these schemes is an important part of managing import costs effectively.

Businesses that regularly import should explore all available reliefs with their customs broker or freight agent. Taking advantage of reliefs can create substantial long-term savings.

Top reasons customs clearance stalls

Despite best efforts, some shipments still encounter clearance delays. One of the most frequent causes is incomplete or inaccurate paperwork, especially around product descriptions and values.

Mismatched HS codes can also flag a shipment for manual inspection.

Customs officers may pause clearance while they investigate discrepancies or request additional documents.

Payment issues are another common problem that triggers holds. If duties or taxes aren’t settled promptly, customs will hold the shipment until payment clears.

Storage fees may be added daily while the goods sit in customs. Over time, these charges can add up to considerable extra costs.

Resolving issues quickly prevents unnecessary delays and expenses.

Common customs clearance mistakes to avoid

Even with the right paperwork, customs clearance can easily go wrong. Some mistakes are far more common than others, and avoiding them can save both time and money.

Here are the main things to watch out for:

- Incorrect HS codes: Misclassifying goods leads to overpaying duties or facing penalties for underpayment. Always verify codes using the latest UK tariff schedules.

- Wrong declared value: Declaring the incorrect commercial value triggers audits or fines. Customs will question invoices that seem unusually low for the goods.

- Missing documentation: Licences, permits, and certificates of origin may all be required depending on the goods. Submitting these late delays clearance.

- Restricted or prohibited items: Some goods require special permissions or cannot be imported at all. Failing to check restrictions leads to holds or confiscation.

- Poor communication between parties: Confusion between importers, brokers, and freight forwarders causes unnecessary clearance delays. Clear coordination avoids errors and holds.

Tips for efficient and cost-effective clearance

Good preparation is the best way to ensure fast, trouble-free customs clearance. Start by reviewing the customs requirements for each destination country before arranging shipments.

Each country may have its own regulations for restricted or controlled goods.

Here are some simple ways to avoid delays and extra costs:

- Work with trusted freight forwarders who handle complex declarations daily and stay up to date with regulations.

- Double-check that all invoices, permits, licences, and certificates of origin are complete and accurate.

- Keep clear, organised records for every shipment to make audits or compliance checks easier.

- Pay duties, VAT, and fees promptly to avoid shipments being held in customs storage.

- Communicate regularly with your freight forwarder or broker to stay updated if any issues arise.

The role of freight forwarders in customs clearance

For many importers, freight forwarders are essential partners in navigating customs clearance. They act as intermediaries, taking over much of the complex paperwork and coordination involved.

This allows businesses to focus on operations while leaving the compliance side to specialists. Freight forwarders stay up to date on changing regulations, both in the UK and internationally.

They know how to correctly classify goods, apply trade agreements, and handle duty calculations. This expertise helps avoid costly mistakes that could delay clearance or trigger inspections.

Many forwarders offer full customs brokerage services, managing documentation, duty payments, and even communication with customs officers. For businesses new to international trade, this support is invaluable.

You can use freight forwarding platforms to find trusted forwarders who specialise in UK customs processes to simplify your import operations. As your business grows, forwarders also help manage larger, more complex supply chains. Whether you’re looking to grow your freight forwarding company or simply need reliable support, having an expert handle customs clearance can save both time and money.

How Brexit changed UK customs clearance

Brexit has brought lasting changes to how customs clearance works for UK businesses.

Before 2021, most trade with the EU moved freely without much paperwork. Now, nearly all shipments between the UK and EU face full customs controls.

Importers and exporters must now submit customs declarations for goods crossing the border. This includes providing HS codes, certificates of origin, and detailed product descriptions for every shipment.

Without the correct paperwork, EU-bound shipments may be refused entry or delayed at the border.

UK businesses trading with Europe must also apply for an Economic Operator Registration and Identification number.

This unique ID is now required for nearly all customs activities. Applying early prevents administrative delays when arranging shipments.

Delays at border control points have become more common, particularly during busy periods. Proper customs preparation is now vital when dealing with both EU and non-EU partners.

Working with experienced freight forwarders can help businesses adjust to these ongoing regulatory changes.

Find reliable carriers and cut your costs with Haulage Exchange

Sign upCustoms clearance FAQs

What does it mean if my package is in customs clearance?

It means your goods are being reviewed by customs to verify paperwork, calculate duties, and ensure legal compliance. Once approved and paid, they’ll move to domestic delivery. This is a normal stage of international shipping.

What is the meaning of customs clearance?

The custom clearances means the legal process where imported goods are inspected, taxed, and approved by customs officials before release. Without clearance, shipments can’t enter the country. This applies to both personal and commercial imports.

How long does customs clearance take?

Most shipments clear within a few hours to a few days if documents are correct. Delays may occur for inspections, payment issues, or incorrect paperwork. Using professional clearance agents often speeds up the process.

What happens after customs clearance?

Once customs clearance completed status is reached, your goods are released for final delivery. Domestic couriers or freight handlers take over from customs. The shipment is then delivered to its end recipient.

Digital tools are now part of daily operations for most haulage companies. From booking loads and tracking freight to running payroll, you likely rely on several connected systems to keep your fleet moving.

But with that reliance comes risk. If those systems go down or get breached, the impact could disrupt more than just a delivery schedule. It could affect your entire business.

That’s where cyber insurance comes in.

What we’ll cover

Why cyber insurance matters in haulage

Gone are the days when cybersecurity was only a concern for banks and tech firms. Haulage companies are now regular targets. Thieves and fraudsters see opportunities in everything from exposed customer data to unsecured driver apps.

You may already use tools like load boards, vehicle trackers, and transport management systems. These are helpful for fleet management, but they’re also common entry points for cyberattacks if not properly protected.

A single incident could cause delays, reputational damage or even stop you from fulfilling your haulage contracts. That’s why it makes sense to look into cybersecurity insurance before something goes wrong.

Common cyber risks for haulage fleets

Cyber risks can show up in many forms. Some target your IT systems directly. Others go after staff, often through convincing scams or fake emails.

Here are a few examples that affect haulage firms:

- Ransomware attacks that lock you out of booking or routing systems

- Fake emails pretending to be from shippers or customers, asking for sensitive info

- Data breaches that expose customer details or payroll records

- Fraud attempts using cloned versions of your company’s site or branding

A serious breach doesn’t just impact your systems. It can also hurt your haulage customer service efforts, delay jobs and make it harder to win new work.

What does cyber insurance cover?

Cyber insurance doesn’t stop an attack from happening, but it helps you recover faster if one does.

Most policies will support you with:

- Emergency IT support to stop the breach

- Help recovering lost data

- Customer notification and legal advice

- Business interruption cover if systems go offline

- PR and communication support if brand reputation is affected

It’s not just about large data breaches either. Even a minor incident can cause big delays if you can’t access your load systems or staff email accounts.

How it protects your load management systems

For hauliers using transport management systems or digital booking platforms like Haulage Exchange, cyber insurance can help keep your core systems protected.

If hackers lock you out or change routing data, a good policy should cover both the cost of recovery and the lost time.

This kind of protection is especially useful if your team uses mobile apps or cloud systems while out on the road.

Does it include cover for payroll and accounts systems?

Many cyber insurance policies also include cover for tools like Xero, QuickBooks or Sage. If criminals gain access to your payment systems, you could face financial loss and serious disruption.

With the right cover in place, you’ll be able to recover funds, investigate the breach, and avoid long-term damage to your accounts processes.

Popular tools used by haulage firms — and why they’re at risk

Many hauliers rely on systems like Mandata, Truckcom, and Teletrac Navman to manage planning, driver communication, and real-time tracking. These platforms help coordinate loads, monitor driver hours and link data with back-office tools.

While these systems offer clear benefits, they’re also connected to the internet and often accessed from multiple devices. That opens the door to risks if a login is compromised or a remote worker’s device gets hacked.

Cyber insurance helps protect you when something goes wrong with these platforms. If your team loses access or data is manipulated, you’ll have support to get back online quickly, without eating into your own profit margins.

What does cyber insurance cost compared to the risk?

Premiums for cyber insurance vary depending on your turnover, number of employees, and systems used. But most haulage firms can expect to pay between £300 and £1,200 per year for standard cover.

That might sound like another overhead, but compare it to the average cost of a small business cyberattack in the UK, which now stands at £15,300 (Source: Gov.uk Cyber Security Breaches Survey 2024).

You could face:

- Loss of income from delayed or cancelled jobs

- Reputation damage, making it harder to win new contracts

- Legal costs and regulatory fines

- IT repair bills and lost time

In that context, the annual premium starts to look like a sensible precaution.

What about GDPR and compliance?

If a breach leads to lost or exposed customer data, it’s not just a technical problem, it can also become a legal one.

Under UK GDPR rules, you must report data breaches to the Information Commissioner’s Office (ICO) within 72 hours. You may also need to notify your customers, suppliers, or partners.

Many logistics cyber insurance policies include legal advice and communication support to help you stay compliant. They may also pay for external experts to handle the investigation and reporting, which helps reduce the pressure on your internal team.

This is especially relevant if you store sensitive client details in cloud systems or handle personal information as part of your booking process.

What if a supplier or partner is breached?

You might take good care of your own systems, but what about the third parties you work with? From freight forwarders to transport management system providers, you probably rely on several other firms to keep things running.

If one of them suffers a cyberattack, you could feel the impact, too.

For example, if your TMS provider goes offline, you might lose access to load data, invoices or customer information. If a subcontractor’s login is compromised, your systems could be next.

Some haulage cyber insurance policies include cover for third-party failures, particularly if their systems are tightly linked to your own. It’s worth checking whether your provider includes this kind of support.

This is especially important in fast-moving 3pl logistics, where shared platforms and external systems are common.

Do you need cyber cover if you already have cybersecurity measures?

Even if you’ve got antivirus software and secure systems, things can still go wrong. Human error plays a big part in most cyber incidents.

Someone clicking the wrong link or entering their login details into a fake site can cause just as much damage as a system flaw.

Having cyber insurance doesn’t replace good cybersecurity; It supports you when those defences don’t hold up.

When cybersecurity insurance becomes a fallback

A strong cybersecurity insurance policy helps you recover from problems quickly. If an attack slips through your protection, it’s this kind of cover that pays for the investigation, recovery and lost income.

That’s especially important when working with freight forwarders and 3pl logistics providers, where trust and response times matter.

Simple steps to strengthen your cyber cover

You don’t need to overhaul your business to take better precautions. Here are a few things you can do now:

- Review your current haulage insurance policy and see if cyber cover is included. Some insurers bundle basic cover, but it may not be enough.

- Talk to your broker about adding or updating a cyber insurance policy. Ask specifically about downtime, legal costs, and support with systems like Mandata or Teletrac.

- Train your team on common scams like phishing emails. Even short training sessions can help prevent breaches caused by human error.

- Check device policies for your drivers. If they’re using phones or tablets to manage jobs, make sure security settings are in place.

- Audit your suppliers. Find out if your key tech providers have security plans in place. Ask how they respond to cyber threats.

Cyber risk might seem like something that happens to “other businesses”, but the reality is that hauliers are just as exposed. And in some cases, even more so. Especially when your day-to-day operations depend on fast, reliable data.

Adding cyber insurance to your risk planning doesn’t just support recovery after a breach. It shows you’re serious about protecting your business, your customers, and your team.

Find reliable carriers and cut your costs with Haulage Exchange

Sign upCyber insurance FAQs

Can logistics cyber insurance help after a ransomware attack?

Yes. Good policies will help you stop the attack, recover your systems and even pay for downtime. That’s especially helpful if your response plans rely on digital tracking or alerts.

If you’re concerned about load security and tech-enabled theft, take a look at our guide to cargo theft and how to protect your fleet.

Is cyber insurance worth it for haulage companies?

Yes, especially if your business uses digital tools daily. The cost of a breach could far outweigh the cost of haulage cyber insurance, making it a sound investment for most operators.

Does cyber insurance cover driver devices?

Many logistics cyber insurance policies include support for devices used by drivers—like tablets or mobile phones—provided they’re used for work and have some security settings in place.

What’s the difference between cybersecurity insurance and traditional liability cover?

Traditional liability might protect you if a load is damaged or stolen. Cybersecurity insurance protects you when digital systems fail or data is compromised. They’re designed to cover different kinds of risk.

Are small fleets also at risk of cyber threats?

Absolutely. In fact, smaller firms can be more appealing to attackers because they often have weaker protection. Whether you run 5 trucks or 50, cyber insurance is worth considering.

If you’re working in road transport, you’ve probably heard the term POA thrown around, but what are periods of availability, really?

In short, it’s a block of time where a driver isn’t doing any work or driving but must still remain available to get going when required.

In this guide, we’ll explain how periods of availability (POA) works, how it differs from breaks and rest, and how to record it correctly using a tachograph.

What we’ll cover

What is a period of availability (POA)

A period of availability is defined as the time when a driver is not working but must still be ready to start work again at short notice. It’s not counted as a break or rest period, but it’s also not classed as active work. To qualify as a POA, the driver must know how long the period will last before it begins.

POA exists to give flexibility to both employers and drivers. It typically applies to scenarios like waiting at borders, depots, or ferry terminals. The important bit is that the duration is predictable and the driver isn’t doing other tasks like loading or paperwork.

If you’re trying to get your head around period of availability and what HGV drivers need to log, think of it as “standby” mode (present but not active). POAs are only one part of the puzzle when managing HGV drivers’ hours. But used properly, they help drivers stay compliant and reduce burnout.

Key characteristics of POA

- Defined in advance: POA must be clearly outlined before it begins. It’s not just free time during the day, it has to be a known, expected pause between tasks. Drivers should never be left guessing how long they’ll be waiting.

- No additional duties: During a period of availability, drivers must not be expected to do anything else. That includes admin work, vehicle checks, loading, or unloading. If you’re doing tasks, it no longer qualifies as POA.

- On standby: The driver has to be available to start working again immediately if needed. That means being present and alert, even if you’re not actively working. It’s a passive period, but not time off.

- Useful for operators: For anyone running a small haulage business, POA offers a bit of breathing room without affecting compliance. It can help balance workloads across multiple drivers. That’s why it’s important to log it correctly and consistently.

Examples of POA scenarios

Let’s say you arrive early at a depot and are told your loading slot is in 45 minutes. That waiting time, if known in advance, is a perfect example of a POA. The key point is that you’re not expected to do anything during the wait.

Another example could be a ferry crossing that takes 90 minutes and where you’re required to stay with the vehicle. You’re not resting, but you’re not working either, and you knew the timing in advance. That’s another tick for a period of availability HGV rules.

Time spent as a passenger in a second vehicle, while being transported to a job site or returning from one, may also count. But again, only if you know how long the ride will take and aren’t expected to perform other duties during it.

These examples are common across the transport sector and important to get right.

Differentiating POA from breaks and rest periods

Understanding the difference between POA, breaks, and rest periods is really important. These are separate time categories with different rules under the working time directive. Getting them confused can lead to incorrect tachograph records and potential fines.

Breaks versus POA

Breaks are legally mandated pauses from work, usually 45 minutes after 4.5 hours of driving. During a break, a driver must not be available for work at all. POAs, on the other hand, require you to remain ready for work even if you’re not actively doing anything.

If you’re on a break, you can’t be interrupted. But on a POA, you can be called back to action. That’s why these two things are never interchangeable, even if they might seem similar on the surface.

Rest periods versus POA

Rest periods are longer, off-duty times where a driver must be free from all work responsibilities. Think daily or weekly rest: at least 11 hours daily or 45 hours weekly. This time is yours, and you’re not expected to work or be on call.

POA is more like being “on hold” at work and it doesn’t replace your rest. Misclassifying POA as rest can lead to non-compliance with drivers’ hours rules.

If you’re starting a haulage company, understanding this distinction is important from day one.

Common situations where POA applies

POA isn’t just a technical rule; it comes up in plenty of real-world driving situations. From scheduled delays to long-distance trips, knowing when to use POA correctly can make all the difference.

Let’s look at a few everyday examples where it applies.

Waiting times with known durations

The classic case is waiting at a loading bay or freight terminal, where you’re told it’ll be a 30–60 minute wait.

If this is confirmed in advance, and you’re not asked to help during that time, it’s a POA. It keeps your working time calculations accurate without cutting into your legal breaks or driving time.

This kind of wait is common in busy depots, especially for just-in-time deliveries. Whether you’re an employee or an owner-operator, logging it as POA is the compliant approach. And if you’re aiming to become an HGV driver, you’ll need to learn this early on.

Travelling as a passenger during work hours

Sometimes drivers are transported between sites or jobs.

If you’re riding in the cab but not working or driving, this may count as POA. Again, the golden rule is: you must know the duration in advance.

If the ride is unscheduled or you’re doing tasks during the journey, it’s not POA. But a known 2-hour transfer with no work expectations? That qualifies. This comes up more often than you’d think in multi-driver or relay jobs.

Recording POA using a tachograph

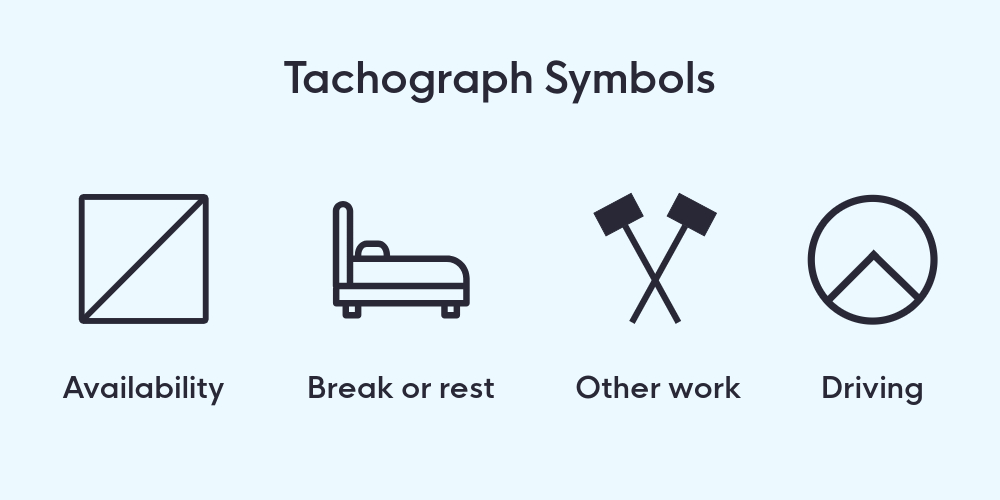

Periods of availability must be logged using the correct mode on your tachograph. It’s usually marked by a square symbol with a diagonal line through the middle. Switching to this mode helps separate it from driving, working, or rest periods.

Accurate tachograph use is required for compliance with tachograph laws. If you get audited or checked during a DVSA roadside inspection, clear records will be your best friend. Plus, it makes life easier when reviewing shifts, pay, or hours limits.

For transport managers, reviewing POA entries can reveal patterns and delays. If you see repeated long POAs at one location, it may be time to change routes or carriers.

These insights help keep operations smooth and costs under control.

Importance of POA in managing working hours

Correctly using periods of availability means you can maximise time on the road without breaking legal limits. It also protects drivers from fatigue and ensures they’re not working too many hours unrecorded.

Especially for new operators or small teams, understanding periods of availability helps keep everything above board when undertaking haulage contracts.

Drivers also benefit. Logging time properly avoids being penalised or overworked. When everyone knows the rules, the whole operation runs more efficiently.

From planning shifts to avoiding burnout, POAs are part of a smart, safe working strategy. They’re not just about ticking boxes, they’re about protecting your people and your business. When used right, they support long-term growth and compliance.

Conditions for a valid POA

- Advance knowledge: The driver must know the expected length of the period before it starts. This can’t be vague or left open-ended, it needs to be clearly communicated in advance.

- No work performed: The driver cannot be asked to complete any job-related tasks during this time. That includes paperwork, vehicle checks, or assisting with loading.

- Availability to resume work: The driver must remain ready to start working again as soon as required. This means they can’t use the time as a break or rest period.

Whether you’re managing a team or running solo, these rules matter. Keeping them in mind helps you avoid penalties and build trust with clients and regulators. They also form part of getting your operator licence and staying compliant.

Find reliable carriers and cut your costs with Haulage Exchange

Sign upFrequently Asked Questions

What is a period of availability for HGVs?

A period of availability in HGV refers to a known window of time during which a driver is not working or driving but must remain available to start work again if needed. It typically applies to situations like waiting for a set delivery slot or travelling as a passenger when not working. These periods must be recorded properly using a tachograph.

Is period of availability paid?

Whether POA is paid depends on your employment contract or company policy. Some employers treat it as paid standby time, while others do not include it in hourly pay. It’s important to clarify this with your employer or include it in your contract.

Is POA classed as a break?

No, POA is not a break, it’s a separate category of time altogether. During a break, you must be completely free of work duties and not available for any tasks. POA, on the other hand, means you’re not working but still on standby.

Do van drivers need to monitor POA?

No, POA only applies to HGV drivers. If you have a mixed fleet of HGVs and courier vehicles, you only need to account for this with your haulage vehicles.

Whether you’re new to the transport industry or scaling up your operations, a firm understanding of HGV insurance keeps your business legally compliant, financially protected, and ready for whatever the road throws at you.

This guide breaks down everything you need to know, from policy types to extras, legal requirements, and how to compare insurance quotes effectively.

What we’ll cover

What is HGV insurance?

HGV insurance is a specialist type of motor insurance designed to cover heavy goods vehicles used for commercial purposes.

It protects against damage, theft, and third-party claims, ensuring that your vehicle (and your business) is covered if something goes wrong. Without it, operating a truck or lorry commercially in the UK is illegal.

It’s not a one-size-fits-all product. Policies can be tailored to cover single vehicles, full fleets, or even temporary use. Depending on what you carry and how far you drive, your needs will probably vary.

Brokers and providers often use terms like truck insurance UK, haulage insurance, or logistics insurance to describe similar policies. While the core principles are the same, each policy comes with its own conditions, limits, and exclusions.

That’s why getting the right HGV insurance quote is so important.

Understanding HGV, truck, and lorry: Key definitions

In the UK, the terms HGV, truck, and lorry are often used interchangeably, but there are key differences:

- HGV refers to a heavy goods vehicle with a gross weight of over 3.5 tonnes.

- “Truck” is a more general term.

- “Lorry” is typically used in everyday conversation to describe larger goods vehicles in the UK.

If you’re unsure which category your vehicle falls into, you should review the official guidelines on lorry sizes and UK regulations. These standards outline the weight classes, length restrictions, and legal requirements for different vehicle types. Knowing where your vehicle stands will help you get accurate cover and stay compliant.

Most insurers will want to know the exact weight, type, and use of your vehicle before issuing a truck insurance quote.

So whether you’re operating a single lorry or managing a large haulage business with a mix of HGVs and courier vans, understanding these definitions is essential to getting the right policy.

Types of HGV insurance policies

Choosing the right type of HGV driver insurance depends on how your vehicle is used, what it carries, and your budget.

In the UK, you’ll usually pick from one of three main policy types, each with varying levels of protection. Let’s look a look:

Third-party only

Legally, this is the least amount of cover you’re allowed to operate with.

Third-party insurance protects you against damage to other people, vehicles, or property, but not your own truck. It’s typically the cheapest option, but it won’t cover cargo theft, fire, or accidental damage to your own HGV.

Third-party, fire & theft

This level includes third-party cover plus protection if your truck is stolen or damaged by fire.

It’s a popular middle-ground choice for older or less valuable vehicles. However, it still won’t cover damage to your truck in a collision you caused.

Comprehensive

Comprehensive haulage insurance covers everything in the previous tiers, plus damage to your own vehicle, even if you’re at fault.

It’s the most complete form of truck insurance in the UK, offering peace of mind in most situations. As you can imagine, this is often the preferred choice for newer or high-value trucks.

Specialised coverage options

Depending on your operation, standard haulage insurance policies might not be enough.

There are several specialised insurance options that offer more tailored protection for different setups. These include:

Fleet insurance

HGV fleet insurance covers multiple vehicles under one policy, making it easier to manage cover and potentially reduce costs.

It’s ideal for large haulage businesses with five or more trucks on the road. Fleet policies can also include mixed vehicle types and drivers.

Temporary insurance

Temporary insurance is useful for short-term cover, and perfect for borrowed vehicles, seasonal work, or short contracts.

You can often get this type of truck insurance online for durations ranging from one day to a few months. It’s flexible and typically cheaper than changing your existing policy.

Telematics insurance

Some insurers offer telematics or “black box” insurance for trucks, using GPS tracking to monitor driving behaviour.

This can lead to lower HGV insurance costs for safe drivers and improved risk management across your fleet. It’s also useful for businesses looking to improve efficiency and reduce incidents.

Optional extras

When getting an HGV insurance quote, it’s also worth considering add-ons that can give you fuller protection.

These extras vary by provider but can make a big difference in case of an emergency. They include:

- Breakdown cover: A must if your truck travels long distances or works overnight. It ensures fast roadside support, minimising delays and loss of earnings.

- Legal expenses: Covers legal costs related to accidents, claims disputes, or licence issues. Handy for operators who want peace of mind without hefty legal fees.

- Goods in transit: Essential if you’re carrying customer freight. It covers damage, loss, or theft of cargo while in your vehicle. Many haulage contractor insurance policies include this as standard.

You might also want to look at haulage goods in transit insurance or light haulage insurance if your operation deals with fragile or high-value goods.

Extras like courtesy vehicles and replacement driver cover are available too. We’d recommend thinking about your risks and day-to-day operations before deciding.

If your business handles sensitive client data or uses digital systems for load bookings and route planning, you should also consider haulage cyber insurance to protect against online threats and data breaches.

Legal and regulatory requirements

To operate legally, all HGV owners must meet a few key requirements. Here’s what you need to know:

- Minimum insurance is a legal must: Every HGV on UK roads must be covered by at least third-party HGV insurance. This applies to solo drivers, those running a small haulage business, and larger companies alike. Driving without proper insurance can result in fines, licence penalties, or even vehicle seizure.

- Drivers need the correct qualifications: All drivers must hold a valid HGV licence appropriate to their vehicle’s class. If you’re just starting out or planning to expand your team, make sure drivers have up-to-date CPC training and medicals. Unlicensed or improperly trained drivers could invalidate your cover.

- Operator licence and business records must be current: If you operate commercially, you’ll likely need an operator licence. While some may search for HGV insurance without operators licence, this is usually only applicable for non-operational or stored vehicles. Staying compliant includes record-keeping, vehicle maintenance logs, and proper documentation at all times.

For better peace of mind, working with an experienced provider like Business Choice Direct ensures your cover is both compliant and tailored to your needs. They understand the unique risks involved in haulage and logistics, helping you avoid gaps in protection. Whether you’re launching or scaling, their support can be invaluable.

Factors influencing premiums and costs

When calculating your HGV insurance cost, insurers consider several factors.

The type of goods you carry, your mileage, and your claims history all play a part. Your vehicle’s value, age, and security setup also affect your premium.

Business size matters, too. A haulage fleet insurance policy might come with discounts, while a private HGV insurance policy for a single truck may have fewer variables. The driver’s age, experience, and endorsements are equally important.

If you’re new to the industry, expect higher premiums at first. As you build up a clean record, your costs may drop over time.

Still wondering how much HGV insurance is in the UK? Rates vary widely, so it’s best to get multiple quotes tailored to your setup.

How to shop and compare HGV insurance policies

The best way to find the right deal is to compare HGV insurance policies across a range of providers.

Look beyond price, making sure to check what’s included, what’s excluded, and whether extras are optional or built-in. A cheap quote isn’t always the best value if you’re left underinsured.

Using HGV insurance brokers can save you time and help you find niche coverage. They often have access to policies that aren’t listed through comparison tools. For specific jobs (like heavy haulage insurance or road haulage insurance) a broker might get you better terms.

Whether you’re getting a truck insurance quote for the first time or renewing an existing policy, go in with clear requirements. Look at excesses, cover limits, and cancellation fees.

And always read the fine print, especially if you’re buying truck insurance online.

Find reliable carriers and cut your costs with Haulage Exchange

Sign upHGV insurance FAQs

How much is insurance for an HGV?

The cost of HGV insurance depends on several factors including your vehicle type, driving history, and the nature of your work. For new operators, prices can start from around £1,500 annually but can vary widely depending on risk and coverage. It’s always best to get a tailored insurance quote from a trusted provider or broker.

Can HGV drivers get cheaper insurance?

In some cases, yes, especially if they have a clean licence, long experience, and no recent claims. Experienced HGV driver insurance tends to be lower than for someone new to haulage. Taking steps like extra training and using telematics can also reduce premiums.

Why is truck insurance more expensive?

Truck insurance cost is higher because the vehicles are large, expensive, and often used for commercial purposes. They also pose more risk on the road and carry valuable or high-risk freight. Specialist cover like haulage insurance or haulage fleet insurance adds protection but also increases the price.

As the UK haulage sector continues to face a shortage of qualified drivers, many fleet operators are now looking beyond domestic recruitment. Recruiting international HGV drivers can help keep loads moving and expand fleet capacity, especially for companies managing mixed fleets of HGVs and vans.

But hiring from overseas comes with extra steps. In this guide, we’ll break down the legal requirements, visa processes and some practical tips to help your team bring in qualified drivers from abroad.

What we’ll cover

Understanding the legal framework

Before hiring from outside the UK, it’s important to understand what the law requires from your business.

Failing to meet immigration rules can lead to fines, delays or even suspension from future hiring schemes.

UK immigration routes for HGV drivers

Most international HGV drivers come to the UK through the Skilled Worker visa route. This visa allows workers to live and work in the UK if they’ve been offered a qualifying job from a licensed sponsor.

Your business must be registered as a sponsor to use this route. This isn’t just a box-ticking exercise. The Home Office expects sponsors to monitor and report on sponsored employees.

Other routes, like temporary worker visas, may apply in some cases, but most long-term hires will need a Skilled Worker visa. Drivers must also meet English language and salary requirements set by UK Visas and Immigration (UKVI).

Right to work checks and compliance

Before your new driver starts work, you’ll need to complete a right to work check. This means verifying the individual’s identity documents and visa status. It’s your responsibility to keep proper records.

Failing to do this properly can result in civil penalties. You’ll also risk losing your sponsor licence, which would impact any future overseas hiring.

Visa sponsorship process for haulage companies

To start recruiting international HGV drivers, you’ll need to become a licensed sponsor. This process involves an application fee, document checks and a commitment to meeting sponsor duties.

How to apply for a sponsor licence

You’ll first need to apply to the Home Office for a sponsor licence. Fees vary depending on the size of your business. Most medium or large fleets will pay the higher rate.

You’ll need to provide company records, demonstrate that your roles are genuine and show you’ve got the right systems in place to monitor sponsored staff. Most applications are processed in around 8 weeks, but delays can happen if documents are missing or unclear.

Once approved, you can assign Certificates of Sponsorship (CoS) to overseas drivers who’ve been offered a role. This is a digital document they’ll use when applying for their visa.

How to manage visa applicants

The Skilled Worker visa process includes biometric enrolment, documentation, and a possible electronic travel authorisation (ETA) for some nationalities. Most decisions are returned within 3 weeks, although it can take longer during busy periods.

While drivers are waiting, make sure they understand what they’ll need on arrival, such as housing, right to work documents and training plans. These early weeks can shape long-term driver retention.

Tips for recruiting international HGV drivers

Once you’ve got your sponsor licence, the next step is finding the right people.

Overseas recruitment takes time and planning, but it can offer strong long-term benefits.

Finding the right candidates

Use experienced recruiters who specialise in sourcing international HGV drivers. They’ll know what to look for in applications and can help you avoid issues with visa rejections or licence conversions.

Pay attention to driver experience, licensing history and the types of vehicles they’re qualified to operate. Knowing the types of lorry your fleet runs will help match candidates more effectively.

Make sure any overseas qualifications can be converted or recognised under UK law. Some drivers may need to take extra tests before they can legally drive here.

Supporting your new recruits

Helping overseas drivers settle into their role isn’t just good practice—it helps with long-term retention. Provide help with accommodation, local travel and general orientation. A welcome pack with basic UK road rules, HGV driver hours and contact numbers can make a big difference.

Include time for familiarisation with routes, your depot, and any digital systems you use. Whether you’re managing HGV drivers directly or through a transport manager, clear communication is key in the early days.

What’s next for fleets hiring abroad?

Bringing in talent from overseas can help your operation grow—especially if you’re struggling to recruit locally. But it’s not a quick fix. It requires planning, patience and a willingness to invest in your team.

As part of your planning, think about long-term staffing needs. You may want to combine overseas hiring with apprenticeships, licence upgrades or internal promotions. Hiring from abroad is just one part of a broader recruitment strategy.

Don’t forget to consider logistics around cabotage regulations if you’re operating across borders. While UK immigration handles visas, EU road rules still apply to foreign-registered vehicles and international journeys.

You’ll also want to review your HGV insurance cover before bringing in overseas staff. Vehicle use, journey types, and driver profiles can all affect what’s covered, and the cost of your insurance premiums.

And of course, keep your operator’s licence details up to date. Any change in your operating model, staffing or safety processes must be reflected in your licence records.

Find reliable carriers and cut your costs with Haulage Exchange

Sign upFrequently asked questions

What are the visa options for international HGV drivers in the UK?

The Skilled Worker visa is the most common route for international HGV drivers. It allows them to work in the UK if sponsored by a registered employer. Other options, like temporary visas, are more limited and often tied to seasonal work.

How can haulage firms become visa sponsors?

You’ll need to apply to the Home Office for a sponsor licence. The process includes submitting business documents, paying a fee and agreeing to meet compliance duties. Once approved, you can assign Certificates of Sponsorship to overseas drivers.

Is recruiting HGV drivers from abroad worth the effort?

Many fleets find it’s worth the time and cost, especially when local recruitment isn’t enough. You’ll need to plan carefully, but bringing in overseas drivers can support long-term growth and reduce empty vehicle time.

What documents do international drivers need to work in the UK?

They’ll need a valid passport, visa, and licence (with any required UK conversions). You’ll also need to complete a right to work check before they start. Some drivers may require additional permits depending on where they’ve trained.

How long does it take to bring a foreign HGV driver onboard?

It can take 2–3 months from start to finish. This includes sponsor licence application, issuing the Certificate of Sponsorship, and visa processing. Planning ahead helps keep your schedules on track when hiring a truck driver from abroad.

Managing drivers’ hours is a core responsibility for any fleet operating heavy goods vehicles (HGVs) and larger vans. These rules exist to keep drivers safe, prevent fatigue-related accidents, and maintain compliance with UK and EU regulations.

For haulage carriers, understanding the rules is just as important as meeting delivery deadlines. Fleet managers must stay on top of driving limits, rest periods, and tachograph rules to avoid penalties and disruptions.

This guide covers UK and EU drivers’ hours rules, AETR regulations, and how these apply to different vehicle types.

What we’ll cover

Why drivers’ hours rules matter

Fatigue is a major risk in road transport. Studies show that tired drivers are more likely to make mistakes, increasing the chance of serious accidents. That’s why driving limits, breaks, and rest periods are enforced with the HGV working time directive.

For businesses, non-compliance can result in penalties, fines, or even loss of your operator licence. The DVSA regularly conducts roadside checks, and any breaches can impact your company’s reputation.

Keeping up with these regulations is an important part of driver management, helping to protect both drivers and the business.

UK drivers’ hours rules for HGV drivers

HGV drivers in the UK follow specific drivers’ hours rules, designed to balance working time with adequate rest.

Driving limits in the UK

- Daily driving limit: 9 hours per day, with the option to extend to 10 hours twice a week

- Weekly driving limit: 56 hours per week (maximum)

- Fortnightly limit: 90 hours in any rolling two-week period

Breaks and rest periods

- A 45-minute break is required after 4.5 hours of driving