- How we help you

Category: Operations

Certain locations across the UK have become all-important to the smooth flow of goods, offering fast access to major roads, rail links, ports, and airports. These logistics hubs handle millions of tonnes of cargo each year, keeping everything from supermarket shelves to factory lines stocked and moving.

For freight operators, choosing the right hub can impact delivery times, storage costs, and long-term growth. In this article, we’ll explore the UK’s largest and most important logistics hubs, and why they’re essential to the country’s transport network.

What we’ll cover

Fleets, bookings, subcontractors, compliance & payments.

With HX, you can manage them all in one place.What counts as a logistics hub?

A logistics hub is more than just a warehouse. It’s a location where goods are stored, sorted, and transferred between different transport modes.

These hubs connect road, rail, air or sea networks and offer 24/7 access. They also support services such as customs clearance, temperature-controlled storage, and freight consolidation.

Successful hubs tend to offer the following:

- Proximity to major motorways or ports

- Road layouts suitable for HGVs and large haulage business operations

- Intermodal transport links, such as rail freight terminals or airport access

- On-site or nearby warehousing and dispatch centres

- Reliable workforce and infrastructure support

For anyone starting a haulage company or scaling operations, location is of the utmost importance. Choosing the right hub can directly affect delivery times and operational costs.

Ranked: The UK’s largest logistics hubs

From deep-sea ports to inland freight terminals, the UK is home to several large logistics hubs supporting national and international supply chains. These sites combine warehousing, transport access, and dispatch operations to keep goods moving efficiently.

1. Midlands Golden Triangle (East Midlands)

Sources: ONS, Ordnance Survey, Esri The Golden Triangle covers an area between Birmingham, Nottingham, and Leicester. It’s known for its dense concentration of warehouses and logistics parks.

This region sits at the heart of the motorway network with the M1, M6, and M40 nearby. It also offers quick access to over 90% of the UK population within a four-hour drive.

Major sites include Magna Park, Hinckley Park and East Midlands Gateway. The latter combines rail freight, warehousing, and airport connections in one integrated site.

The Golden Triangle is ideal for fast-moving goods, retail distribution, and national supply chain networks. Its central location makes it one of the most valuable areas for multimodal logistics.

2. DIRFT (Daventry International Rail Freight Terminal)

DIRFT is one of the UK’s most advanced inland intermodal transport terminals. It sits just off the M1 in Northamptonshire, connecting road and rail networks.

This hub allows for efficient freight movement from the Channel Tunnel and major ports to inland destinations. It plays a huge role in reducing road congestion by shifting volume to rail.

DIRFT is surrounded by large warehouses and dispatch centres used by leading supermarkets and retailers. It is particularly strong in grocery logistics and time-sensitive supply chains.

The terminal is constantly expanding, too. It continues to grow as a hub for freight forwarders seeking reliability and scale.

3. Port of Felixstowe

Felixstowe is the UK’s busiest container port, handling over 4 million TEUs annually. It serves as a major entry point for goods arriving from Asia and beyond.

Its deep-water berths accommodate the world’s largest vessels. And, the port connects to inland hubs via rail and the A14, providing access to the Midlands and beyond.

Felixstowe has nearby warehousing zones and a dedicated rail terminal. It’s an important hub for international trade, especially for businesses reliant on containerised freight.

4. Port of Southampton

Southampton is a deep-sea port known for its automotive and container traffic. It’s also the UK’s second-largest container port after Felixstowe.

The port serves global shipping routes, particularly linking the UK with the Americas and the Far East. It’s a preferred choice for businesses moving high-value and time-sensitive goods.

With road and rail access to the Midlands and London, Southampton supports regional distribution. It’s also heavily used by the automotive sector for import and export.

For haulage and logistics operators focusing on global trade? Southampton is an indispensable southern gateway.

5. Port of Liverpool / Seaforth

Liverpool is the principal west coast port and a growing alternative to southern ports. The Seaforth terminal supports containerised cargo and short-sea shipping.

The port links directly to the M62 and M6, facilitating easy access to the North West and Midlands. It also offers ferry routes to Ireland and transatlantic services.

Liverpool is increasingly used by freight forwarders due to reduced congestion and improved turnaround times, and it’s a valuable link in the UK’s north-south distribution system. Plus, the surrounding area has become a logistics cluster, supporting storage and dispatch for FMCG and retail.

6. The Humber ports (Immingham, Grimsby, Hull)

The Humber ports collectively form the UK’s largest port complex by tonnage. Immingham alone handles more than 55 million tonnes per year.

These ports are very important for bulk cargo, Ro-Ro services, and offshore energy supply chains. They serve sectors such as fuels, chemicals, cars, and foodstuffs.

Road and rail access connects these ports to Yorkshire, the East Midlands, and the North – plus, The Humber is also emerging as a hub for renewable energy logistics. For large haulage business operators serving the North, the Humber offers scale and sector diversity.

7. London Gateway & Thames Freeport

London Gateway is a modern deep-sea port operated by DP World. It’s part of the Thames Freeport, which provides tax and customs incentives.

The port is supported by a vast logistics park offering on-site warehousing. It’s also rail-connected and close to the M25, allowing for rapid movement into London.

As a newer facility, London Gateway is designed for automation and efficiency, and it supports both import-heavy and e-commerce focused supply chains. This hub is ideal for businesses looking for scalable logistics in the South East.

8. Heathrow Cargo & surrounding logistics cluster

Heathrow is the UK’s largest air freight terminal, handling over 1.5 million tonnes annually. It’s essential for high-value, time-critical cargo.

Surrounding Heathrow are logistics parks, bonded warehouses, and courier hubs. This ecosystem supports fast processing and same-day dispatch.

Sectors such as pharmaceuticals, fashion, and electronics rely on air cargo. The Heathrow cluster plays a unique role in the UK’s multimodal logistics system, and for freight forwarders handling international freight, it’s an important hub.

Why these hubs dominate: location, access and infrastructure

Several factors explain why these hubs have risen to prominence. However, strategic location is the most obvious.

Many of the UK’s top hubs are situated near major motorways like the M1, M6, and M40. These allow easy north-south and east-west movement by road.

Rail links further boost intermodal capabilities. Sites like DIRFT and East Midlands Gateway, for example, demonstrate the value of combining rail freight with warehousing.

Other reasons include:

- HGV-friendly infrastructure and secure HGV parking

- Proximity to population centres or manufacturing zones

- 24/7 operational access

- Freeport or customs clearance advantages

- Local government and private sector investment

Together, these features reduce delivery times, and support large-scale operations. Plus, they also improve overall supply chain efficiency.

Regional breakdown: north, midlands, south and devolved nations

The Midlands remains the dominant inland region for logistics. Its central location supports nationwide delivery within tight timeframes.

Northern regions are seeing significant growth in warehousing and freight movement. Doncaster and Warrington are two examples of strong regional logistics centres.

In the South, ports and air hubs lead the way. Southampton, London Gateway, and Heathrow provide all-important links for international freight.

Scotland’s main logistics activity centres around Glasgow and Grangemouth. Wales has emerging logistics parks near Cardiff, while Belfast supports multimodal transport in Northern Ireland.

Emerging and rapidly growing hubs to watch

As demand grows, new hubs are gaining ground:

- Doncaster iPort: Offers road and rail connections with vast warehouse capacity.

- Teesport: Positioned for offshore, energy, and chemical logistics.

- Avonmouth (Bristol): Serving the South West with new distribution centres.

- East Midlands Gateway: Rapidly expanding hub for airport, rail, and road freight.

These locations are attracting investment due to their connectivity and available land. They’re particularly attractive to businesses seeking long-term growth outside traditional hotspots.

What sectors each hub serves

To understand the role of each logistics hub, it helps to know which industries they support. Different sectors rely on different modes of transport, storage types and distribution speeds.

Here’s a quick breakdown:

Logistics hub Main sectors Golden Triangle National retail, e-commerce, FMCG DIRFT Parcel networks, food logistics, rail freight Felixstowe Imports, manufacturing, consumer goods Southampton Automotive, containers, deep-sea routes Liverpool / Seaforth FMCG, Ireland/US exports, regional freight Humber ports Bulk transport, energy, offshore, automotive London Gateway Fast retail turnover, high-volume imports Heathrow Cargo Pharmaceuticals, electronics, luxury goods Some hubs are designed to serve a wide mix of industries. Others are highly specialised, offering temperature control, bonded storage or fast customs processing.

What this means for logistics operators and fleets

For any logistics business, location is a strategic choice. Where you base your vehicles, store goods or link up with couriers can impact your entire delivery model.

Operators with national routes benefit from basing near motorway-connected hubs. This reduces delays, improves routing and allows more flexible load planning.

Those focusing on import/export can save time and cost by using port-adjacent warehouses. Ports like Felixstowe or Liverpool are ideal for companies needing access to customs and international freight corridors.

Businesses using intermodal transport will prefer hubs with on-site rail links. These facilitate smoother transfers between long-haul and last-mile logistics.

Here are a few operational takeaways:

- Fleet planning: Hubs with good road access reduce dead mileage and allow tighter delivery windows.

- Warehouse decisions: Choosing a site near a major hub can cut lead times and support seasonal surges.

- Scalability: Emerging hubs often offer room for growth, lower rents and less congestion.

- Customer expectations: Using the right dispatch centre can help you promise next-day or same-day delivery more reliably.

- Partnerships: Many freight forwarders cluster near major hubs. Being close makes collaboration easier and more cost-effective.

Whether you’re an established firm or just starting a haulage company, hub choice matters. It affects everything from profitability to customer satisfaction.

Find reliable carriers and cut your costs with Haulage Exchange

Sign upFrequently asked questions

Which are the biggest logistics hubs in the UK by volume?

Felixstowe leads in container volume, followed by Southampton and London Gateway. Immingham handles the highest overall tonnage due to bulk and energy cargo.

Why is the Golden Triangle considered the UK’s leading logistics region?

It provides access to most of the UK within four hours and sits at the intersection of major motorways. Its dense concentration of warehouses and transport links makes it ideal for nationwide distribution.

What sectors rely most on the major logistics hubs?

Retail, automotive, pharma, e-commerce, fashion and FMCG are the biggest users. These sectors rely on fast, reliable and scalable logistics services.

What is the difference between a logistics hub and a distribution centre?

A logistics hub includes warehousing, intermodal connections and transport services in one zone. A distribution centre is typically a single facility within a wider hub.

What factors determine where new logistics hubs are built?

Transport links, land availability, labour force, and planning permissions all matter. Freeport status or tax incentives can also influence site selection.

Moving wide or heavy goods vehicles is never straightforward. When your cargo exceeds legal measurements, strict UK rules apply to protect both the road network and your operator licence.

Knowing the thresholds for HGV width UK limits (and what happens once you pass them), helps you stay compliant and avoid costly delays. Operators who understand how to plan, notify, and document every move are always one step ahead.

What we’ll cover

Fleets, bookings, subcontractors, compliance & payments.

With HX, you can manage them all in one place.Definitions and thresholds for wide and abnormal loads

A vehicle becomes a “wide load” when its total width exceeds 2.9 metres. An “abnormal load” is one that weighs more than 44 tonnes, extends beyond 18.65 metres in length, or reaches over 4.95 metres in height.

These measurements apply to indivisible goods, meaning items that can’t reasonably be broken down for transport. Examples include wind turbines, bridge beams, or large construction machinery.

For standard freight, the HGV width UK limit is 2.55 metres, or 2.6 metres for refrigerated vehicles. Anything beyond this requires additional permissions and specific routes.

The UK’s haulage rules for vehicle size and load combinations are explained in our guide to lorry sizes and UK regulations. Understanding these limits is the first step toward safe and compliant abnormal load operations.

Here’s a quick summary:

Measurement Standard HGV limit Abnormal load threshold Width 2.55 m (2.6 m for refrigerated) Over 2.9 m Weight 44 tonnes (gross) Over 44 tonnes Length 16.5 m articulated / 18.75 m drawbar Over 18.75 m Height No statutory limit Over 4.95 m (practical restriction) Overhang Up to 1 m front / 2 m rear Over specified values must be marked Legal framework: C&U regulations, STGO, and Special Orders

Two main regulations govern abnormal load movements in the UK: the Road Vehicles (Construction & Use) Regulations 1986 and the Road Vehicles (Authorisation of Special Types) (General) Order 2003, or STGO. These define what counts as a legal HGV and when exemptions apply.

C&U regulations cover everyday haulage, while STGO applies to vehicles carrying heavier or longer indivisible loads. STGO is divided into three categories:

- Category 1: up to 50 tonnes

- Category 2: up to 80 tonnes

- Category 3: up to 150 tonnes

Each category has its own rules around notice periods, escort requirements, and operating conditions. Category 1 moves are relatively straightforward, while Category 3 operations may require overnight travel or police attendance.

Anything beyond those limits falls under a Special Order, granted by the Department for Transport. These are reserved for exceptional cases, such as major infrastructure or energy projects.

Trials of longer heavier vehicles (LHVs) highlight how wide load regulations UK continue to adapt as logistics evolves. For operators, that means staying informed about rule changes and testing programmes that could shape future road limits.

Notice requirements to police, highways, and bridge authorities

Before transporting a wide or abnormal load, operators must notify all relevant authorities. This includes the police, highway departments, and any bridge or structure owners along the chosen route.

Notification is required once the HGV width UK measurement exceeds 2.9 metres or the vehicle’s total weight goes beyond 44 tonnes. These notices allow authorities to check road safety, manage diversions, and protect public infrastructure.

When to use ESDAL and offline forms

The Electronic Service Delivery for Abnormal Loads (ESDAL) platform simplifies the process by notifying all relevant bodies automatically. It ensures your documentation reaches everyone affected by your route in one submission.

Some areas still rely on traditional paper or email-based notification systems. Understanding which method applies to your route can prevent costly delays or denied movements.

Planning complex or sensitive journeys requires careful coordination between authorities, clients, and drivers. Find useful guidance for managing communication and compliance in our article on high-risk freight best practice.

Lead times and information to include

Notice periods range from two to five working days, depending on the type of move. Your notice should include vehicle dimensions, axle weights, escort information, and proposed route and travel times.

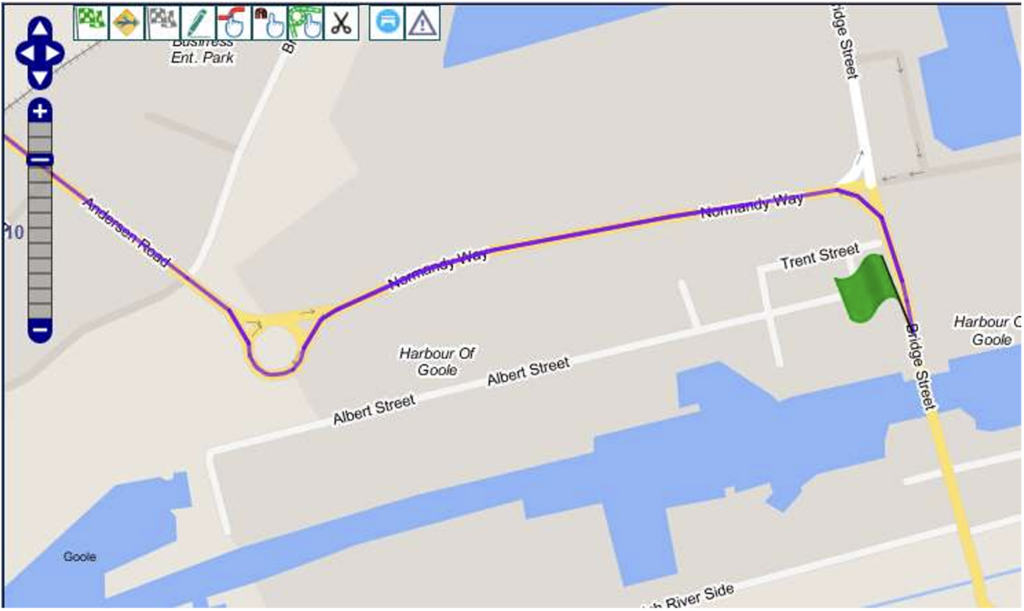

Mapping out a route on the ESDAL system. Make sure to submit accurate information, as even small errors can void approval and delay operations. Always double-check measurements before sending notifications.

Attendants, escorts, and when they are required

Attendants and escort vehicles are all-important when moving large or complex loads. They provide visibility, manage traffic, and help navigate challenging sections of the route.

Wide loads over five metres or long combinations over thirty metres typically require escort support. Escorts are also needed where visibility is limited or routes pass through urban areas.

For exceptionally large or high-risk movements, police escorts may be mandatory. Communicate early with the relevant police force to help secure availability and prevent last-minute complications.

Trained attendants assist with manual signalling and clearance checks, ensuring that every stage of the journey is properly managed. As a side note, having experienced support makes heavy haulage safer and more efficient.

Power station components being transported through Suffolk in 2023 with a police escort. Credit: Suffolk County Council. Marking, lighting, and visibility for long and wide load projections

Oversized vehicles must be clearly visible to other road users. Amber beacons, red-and-yellow rear conspicuity markings and chevrons, and reflective panels are standard requirements for all abnormal load operations.

During daylight, bright flags or markers are used for any projections that extend beyond the vehicle’s main body. At night, those projections must be illuminated to remain visible from a distance.

These safety measures are consistent across wide load regulations in the UK. They aren’t just about compliance; they protect both the operator and everyone else on the road.

An example of an escort vehicle for abnormal loads. Source: GHM Group Vehicle choice and trailer types for abnormal indivisible loads

Choosing the right trailer setup is important for both safety and compliance. Low-loaders, extendable flatbeds, and modular trailers are all used to move indivisible loads such as large machinery or prefabricated structures.

Each design serves a purpose. For example, low-loaders help with tall cargo, while modular platforms distribute heavy weight across more axles.

Securing the wide load and documentation to carry

A well-secured load is both a safety and legal requirement. Chains, straps, and tensioners must be correctly rated and in sound condition before departure.

Operators are responsible for inspecting all securing equipment regularly. That’s mainly because damaged or worn restraints are among the most common causes of roadside penalties.

Important documents to keep on hand include the STGO order, indemnity form, and route plan, which confirm that authorities have been notified. Digital records like tachograph data are also essential for demonstrating compliance, as detailed in our guide to tachograph regulation.

Planning the move, risk assessment, timing, and roadworks

Planning an abnormal load journey involves more than plotting a route. Operators must review bridge heights, restrictions, and environmental conditions before setting off.

A written risk assessment helps identify potential issues such as poor weather, narrow junctions, or unexpected roadworks. It’s a valuable document for both safety and accountability.

Here’s a checklist for effective route planning to help you along:

- Measure vehicle height, width, and weight once fully loaded.

- Confirm bridge and tunnel clearance for the planned route.

- Submit authority notifications early.

- Schedule travel outside peak hours.

- Coordinate escort and attendant communication systems.

- Inspect securing equipment and warning lights.

Penalties, enforcement, and staying compliant

The DVSA and local police closely monitor abnormal load movements. Any failure to comply with STGO or notice requirements can lead to fines, licence suspensions, or even prosecution.

Common issues include missing authorisations, inadequate signage, or incorrect weight declarations. Be warned that enforcement teams regularly check axle loads and documentation at DVSA roadside inspections.

Compliance also supports business credibility and client trust. Many logistics contracts now include clauses that penalise subcontractors for regulatory breaches. Ongoing training and audits help operators stay up to date with legislation.

If you’re determined to become an HGV driver, be sure to explore training routes and license options beforehand.

Find reliable carriers and cut your costs with Haulage Exchange

Sign upFrequently asked questions

What counts as a wide load in the UK?

A wide load is any vehicle or combination exceeding 2.9 metres in total width. This typically includes machinery, prefabricated units, or other large industrial goods.

What is an abnormal load and how is it defined?

An abnormal load surpasses one or more of the standard threshold: 44 tonnes in weight, 18.65 metres in length, or 2.9 metres in width. These moves require prior notification and STGO approval.

What paperwork must I carry during an abnormal load move?

Operators must carry an authorisation order, indemnity form, and route plan. Tachograph data and proof of insurance should also be available for inspection.

Can I move an abnormal load at night?

Yes, but only with approval from relevant authorities. The load must be well lit, clearly marked, and may require escort support.

Do I need a risk assessment for abnormal load transport?

Yes, it’s a core part of safe and compliant operations. A risk assessment helps you prepare for route hazards and avoid unexpected issues.

There’s no shortage of talk about the UK’s logistics sector, but when it comes to hard numbers, things can get a little murky. So how many haulage companies are there in the UK right now? And how do we even define them?

This guide breaks down the best available data to give you a clearer picture. We’ll explain which sources are used, how many operators exist by size and region, and why some estimates vary between datasets.

What we’ll cover

Fleets, bookings, subcontractors, compliance & payments.

With HX, you can manage them all in one place.What we counted: definition, scope, and exclusions

First, it’s important to define what we’re actually counting. Not every logistics business qualifies as a road haulage operator.

For the purposes of this guide, we’ve focused on licensed goods vehicle operators; those moving freight by road as a core service. This includes owner-drivers, small fleets, and large multi-site companies.

We’ve excluded courier companies, removal services, taxi trucks, and local delivery startups. These can be part of the broader logistics industry UK operators work in, but they fall outside standard definitions of haulage companies.

Headline number and date of estimate

As of late 2024, there were around 57,000 licensed haulage companies in the UK. This number reflects active goods vehicle operator licences.

That headline figure is based on the most up-to-date Traffic Commissioner records and data from the Office of the Traffic Commissioner (OTC). It’s important to note that licence status can change, so figures are best read as estimates.

Where the number comes from: sources and methodology

The primary source for haulage company numbers is the UK’s Office of the Traffic Commissioner. This body manages operator licences and publishes regular data.

Other inputs include analysis by trade bodies like the RHA and sector-specific reports from commercial researchers. Some third-party estimates include dormant firms or expired licences, which can inflate the numbers.

For accuracy, we’ve leaned on licence data as it’s tied to legal requirements for running HGVs. If you’re thinking of entering the industry, we’d recommend reading up on how to get an operator licence.

British haulage companies by region and devolved nations

Haulage companies UK-wide are unevenly distributed. England hosts the majority with 49,000 haulage companies, with hotspots in the Midlands, the North West, and South East.

Scotland accounts for around 5,000 firms, with a further 2,000 in Wales and 1,000 in Northern Ireland. Population density and proximity to major freight routes play a big role in these differences.

Regional clusters often reflect port access, warehouse infrastructure, and industrial presence. The East of England and the Humber region remain important for import-export operators.

Companies by size band: micro, small, medium, and large

Most UK haulier companies are small; in fact, micro-firms (with fewer than 10 staff) make up nearly 90% of the sector. These include many owner-operators and family-run firms.

Small businesses (10-49 employees) and medium-sized ones (50-249 employees) form the mid-tier. There are only a few hundred large haulage businesses with 250+ staff, but they dominate long-distance freight routes.

If you’re one of the many running or thinking of running a small haulage business, the market remains competitive but viable. Large operators like Wincanton and Eddie Stobart lead the big haulage companies in the UK.

Fleet and operator licences at a glance

According to recent data, over 430,000 HGVs are currently registered for commercial use. However, the number of operator licences is far lower.

That’s because many businesses run multiple vehicles under a single licence. Fleet size can vary widely, as some licences cover a single truck, while others manage hundreds.

Hauliers must renew their operator licence every five years. Strict rules apply, especially regarding safety, maintenance, and the financial standing of the business.

Employment snapshot: drivers and wider workforce

The UK’s haulage sector supports over 300,000 HGV drivers, though that number fluctuates with demand. Brexit, COVID-19, and working conditions have all had their impact on retention over the years.

Alongside drivers, haulage companies employ logistics planners, admin staff, compliance officers, mechanics, and warehouse workers. The wider workforce often doubles the headcount shown in driver-only statistics.

Driver recruitment remains an enduring issue. If you’re looking to expand your team, we’ve covered how to hire HGV drivers in 2025 in a separate guide.

How the total has changed in recent years

Haulage company numbers have seen modest growth since 2020. After a dip during the early pandemic, business registrations recovered steadily in 2022 and 2023.

High fuel prices and regulatory challenges caused some consolidation. However, interest in starting a logistics business remains strong, as covered in our guide to starting a haulage company.

Digital platforms, flexible contracts, and the rise of last-mile delivery all played a role in reshaping the market. So has the post-Brexit landscape, which continues to impact driver supply and cross-border operations.

Challenges facing UK haulage companies

The UK haulage industry has faced one hurdle after another over the past few years. From labour shortages to regulatory confusion, here are some of the biggest challenges still impacting haulage businesses:

- Driver shortages remain a major issue: Although the crisis has eased slightly since 2021, there is still a lack of qualified HGV drivers across the UK. Older drivers are retiring, and not enough younger recruits are joining the industry.

- Fuel costs continue to put pressure on margins: Haulage companies are heavily impacted by rising diesel prices, especially smaller firms with tighter budgets. Fuel accounts for one of the largest overheads in the business.

- Regulations and Brexit red tape make cross-border work harder: Since Brexit, companies operating across the EU-UK border face more paperwork, customs delays, and compliance costs. This especially affects businesses that rely on just-in-time deliveries.

- Low rates and high competition squeeze small operators: Many small haulage firms find themselves undercut by larger competitors or online marketplaces. As a result, they’re often forced to take contracts with razor-thin profit margins.

- Warehouse backlogs and port delays are ongoing: Delays at ports like Felixstowe and congestion at major distribution centres slow down the supply chain. This affects delivery times and increases idle time for drivers.

- Urban emission zones are expanding: London’s ULEZ and similar schemes in other cities are forcing hauliers to upgrade fleets to cleaner vehicles. That comes at a high cost, especially for older companies with non-compliant lorries.

Why estimates vary and how to compare datasets

You might see different figures depending on the source. That’s partly because of differing definitions; some include all logistics firms, while others count only those with valid operator licences.

Government data tends to be more conservative. Industry groups may include expired or dormant registrations to show sector size.

To compare properly, check whether the number reflects registered companies, active licences, or VAT-registered logistics firms. Also note the timeframe, as annual updates can lag behind real-time changes.

Find reliable carriers and cut your costs with Haulage Exchange

Book a demoFrequently asked questions

Are couriers and removals businesses included?

No, unless they hold a goods vehicle operator licence and primarily move freight. Couriers often fall into a separate category under light goods vehicles.

Why do estimates vary between sources?

Different datasets use different criteria. Some count all VAT-registered businesses under freight categories, while others rely on licensing data.

What’s the typical size of a UK haulage firm?

Most British haulage companies are small, with just one or two vehicles. Owner-drivers and family-run firms still make up the backbone of the sector.

How many vehicles per company on average?

It varies, but most UK haulage companies run fewer than five vehicles. Only large operators push into the 50+ range.

Are owner-drivers counted as companies?

Yes, if they hold an operator licence and operate commercially. Many micro-firms in the UK haulage industry are made up of just one person.

The UK’s logistics sector is booming, and with growth comes opportunity. Whether you’re driving freight, directing fleets or managing multi-channel supply chains, logistics offers a wide range of high-paying roles for skilled professionals.

In this guide, we’ll break down the top-paying logistics jobs in the UK, explore why certain roles command higher salaries, and show you what qualifications, experience and specialisations can help you earn more.

From coach driver salary ranges to strategic supply chain leadership, we’ll cover the full spectrum of roles in today’s logistics industry.

What we’ll cover

Fleets, bookings, subcontractors, compliance & payments.

With HX, you can manage them all in one place.What logistics covers and why certain roles pay more

Logistics covers everything from transportation and warehousing to supply chain strategy, procurement and analytics. Pay scales rise quickly as roles become more strategic, tech-driven or require high compliance and planning expertise.

Specialised logistics jobs like customs management, cold chain logistics, and transport analytics tend to attract higher salaries. That’s because these roles demand deep knowledge, certifications, and experience that help businesses run efficiently and legally.

Some roles also involve greater risk, decision-making authority, or oversight of important national infrastructure. These added responsibilities often translate directly into higher compensation.

Salary snapshot for top logistics roles in the UK

Here’s a look at the average salary ranges across the UK logistics industry:

Role Average Pay (UK) Senior Band (London/Strategic) Coach Driver £27,000 – £36,000 £38,000+ Supply Chain Director £85,000 – £120,000 £130,000+ Logistics Manager £45,000 – £65,000 £70,000+ Transportation Manager £40,000 – £60,000 £65,000+ Warehouse & Ops Manager £35,000 – £55,000 £60,000+ Procurement Manager £45,000 – £70,000 £80,000+ Customs Compliance Manager £50,000 – £75,000 £85,000+ Logistics jobs with strategy, compliance or network responsibilities offer the most earning potential. Sector and region matter too – coach driver salary UK data shows earnings peak around London, airports and major hubs.

Top high-pay roles in logistics

The logistics sector includes a wide range of roles, but some stand out for their earning potential. These positions often involve strategic oversight, high responsibility or specialist knowledge that’s in short supply.

Chief or director of supply chain

These senior professionals oversee entire supply chains from sourcing to delivery. They handle large budgets, high-pressure decisions and international logistics strategy.

Salaries rise quickly for those leading multi-site or international operations. Many come from backgrounds in procurement or distribution before stepping into this leadership role.

Supply chain manager

They coordinate production, inventory, transport and procurement operations. Experienced managers can rise into six-figure roles with cross-border or multi-sector responsibilities.

Industries like manufacturing, defence and retail offer high salaries at this level. Many managers pursue certifications like CILT to boost earnings.

They also play an important role in sustainability and cost control, often tasked with implementing greener transport options. As supply chains grow more complex post-Brexit, demand for experienced managers has increased across the UK.

Logistics or distribution manager

These logistics jobs manage warehouse teams, last-mile delivery and route optimisation. Pay increases significantly with scale, larger fleets, automated systems and complex delivery networks.

In e-commerce or 3PL sectors, bonuses and retention packages are common. Management software and people leadership are essential skills.

These managers often handle night shifts, cross-dock operations and returns logistics. Retailers and third-party providers rely on them to reduce delays and streamline delivery performance.

Transportation manager

This logistics job involves overseeing vehicle operations, HGV schedules and regulatory compliance. It’s a stepping stone to higher-paying fleet management and directorial roles.

You may also manage a team of drivers and negotiate contracts with hauliers. Those who have completed a become an HGV driver qualification often progress into these management roles.

They also guarantee compliance with driver hours, safety checks and DVSA regulations. Larger employers expect transport managers to lead digitisation and reduce fuel consumption across fleets.

Supply chain or logistics analyst

Data-focused logistics roles that analyse performance, optimise routing and reduce costs. These roles are rising fast in the logistics industry salary scale due to digitisation and sustainability efforts.

Most roles require strong Excel, SQL or ERP software skills. They often lead into planning or network design jobs.

Analysts are also responsible for creating dashboards, reporting KPIs and identifying inefficiencies across supply chain networks. With more companies relying on predictive analytics, this role continues to grow in demand and value.

Warehouse and operations manager

Operations managers handle staffing, inventory, KPIs, and safety compliance. Those in large depots, especially for retail or e-commerce, see higher bonuses and logistics salary growth.

Warehouses serving online retailers operate 24/7, so flexibility and workforce management are essential. Experience with WMS software and stock accuracy targets is also a major plus.

Procurement and purchasing manager

These logistics roles focus on sourcing goods, negotiating supplier contracts and reducing spend. Strategic procurement often links to board-level decision-making, increasing pay.

Leadership in this area is covered in more detail below. This role overlaps often with customs, finance and sustainability departments.

Customs and trade compliance manager

Experts in import/export law, Incoterms and trade regulations. They’re responsible for keeping operations legal and avoiding costly fines – and their salaries reflect this responsibility.

They often work closely with freight forwarders and government bodies. This role has grown post-Brexit and is in high demand.

Coach driver salary: A key role in UK logistics

A coach driver salary in the UK typically ranges from £27,000 to £36,000, depending on experience and route type. In larger cities or with private charters and tour operators, salaries may rise beyond £38,000.

To become a coach driver, you need a PCV licence, but what is that exactly? The PCV driver meaning refers to a “Passenger Carrying Vehicle” licence, which qualifies you to drive coaches or buses professionally.

So, how much do coach drivers earn compared to other transport roles? While not as high as logistics managers, coach drivers benefit from job security and regular overtime.

Here’s a breakdown:

- Base salary: £27,000 – £36,000

- With overtime: Up to £40,000+

- Private charters or tourism: Premium rates and bonuses

Many wonder how much does a coach driver earn with extra responsibilities like route planning or training. Those additional tasks can increase pay or lead to promotions into fleet management.

High‑earning specialist roles

In the logistics industry, certain specialist functions operate at the cutting edge of the supply chain, and command premium pay as a result.

These logistics roles typically involve a combination of niche expertise, strategic influence and high accountability, pushing their salary bands above standard operations roles.

Procurement and purchasing leadership

- Salary range: £50,000 ‑ £90,000 for senior managers, with director levels from around £75,000 up to £108,000+ depending on remit.

Senior procurement officers and heads of sourcing are among the highest paid delivery jobs UK wide. Their influence on cost-saving and supplier partnerships makes them top earners.

They often report directly to finance or operations directors. Pay is highest in sectors like manufacturing and defence.

Analytics and optimisation roles

- Salary range: £30,000 ‑ £45,000 for analysts; senior optimisation or network modelling roles can reach £50,000+ in some cases.

Data science and logistics combine in these positions – think supply chain analysts or network modellers. Strong Excel, SQL and supply chain system knowledge are important.

These professionals are essential for reducing costs and improving performance. They’re also valued in green logistics or carbon reporting.

Advanced data skills let them simulate distribution models, forecast inventory trends and streamline procurement. Many companies now consider this role mission-critical for competitive advantage.

Fleet and transportation management

- Salary range: £36,000 ‑ £70,000+ depending on size of fleet and region (London/multi‑site may drive higher pay).

Fleet directors often manage dozens or hundreds of vehicles, HGV compliance, and driver strategy. These roles overlap with coach driver salary trends – with management often earning double.

Leadership, route planning software and safety compliance are core skills. This role requires balancing operational efficiency with driver satisfaction.

Fleet managers also oversee vehicle acquisition, HGV insurance, servicing, and emissions compliance. Those operating across multiple depots can earn significantly more due to the complexity involved.

Specialisations with premium pay

Some areas of logistics require rare technical skills, high compliance standards, or advanced planning capabilities, and the pay reflects that.

These specialisations are needed for high-stakes operations and often lead to some of the best salaries in the industry.

Cold chain logistics

- Salary range: £45,000 – £70,000+

Cold chain logistics specialists make sure temperature-sensitive products (like vaccines or fresh food) stay within tight limits across the supply chain. Mistakes can cause catastrophic losses, making this a high-pressure, high-reward field.

Customs compliance

- Salary range: £50,000 – £85,000+

These managers handle cross-border documentation, tax rules and regulatory filings. Since Brexit, demand has surged in freight, e-commerce and global logistics sectors.

Network planning and logistics engineering

- Salary range: £50,000 – £80,000+

Network planners optimise where to place warehouses, how to route deliveries and how to reduce costs. They use modelling software and work closely with procurement and operations teams.

Career progression pathways in logistics

You don’t need to start at the top to reach high-paying logistics jobs. Many professionals move up from warehouse assistant to team lead, transport planner and eventually logistics manager.

Important steps include getting certifications, learning logistics software and moving into analytical or supervisory roles. With effort, it’s possible to move from entry-level operations into high-earning supply chain careers.

Those looking to switch logistics roles entirely can also explore how to start a freight forwarding company. These entrepreneurs often earn six-figure incomes.

Many start as admin assistants or route planners before specialising. With digital transformation accelerating, gaining software skills is often a faster route to higher pay than traditional pathways.

How to qualify: skills, certifications and experience

You don’t always need a degree to succeed in logistics. However, many high-paying logistics jobs require:

- Certifications: CILT UK, CPC, Lean Six Sigma, APICS

- Experience: Multi-site, international or regulated environments

- Skills: Data analysis, procurement negotiation, project management, HGV compliance, leadership

For coach or HGV roles, a valid licence and clean record are must-haves. Strategic roles, on the other hand, demand leadership, communication and strong commercial awareness.

To break into the field, start with entry-level logistics roles and work your way up. Logistics careers reward long-term development, hands-on knowledge and technical growth.

Find reliable carriers and cut your costs with Haulage Exchange

Sign upFrequently asked questions

Which logistics jobs pay the most in the UK?

Director-level roles like Supply Chain Director, Procurement Head, and Customs Compliance Manager top the list. These jobs carry high responsibility, strategic oversight and often multinational complexity.

Do I need a degree or will certifications and experience be enough?

You can progress without a degree, especially in operations or transport roles. Certifications like CILT, CPC or Six Sigma are widely accepted and often more practical.

Which industries offer premium pay for logistics roles?

Sectors like pharmaceuticals, defence, cold-chain logistics and e-commerce offer the highest pay. These industries deal with sensitive, high-value or fast-moving products.

Is London pay higher than the rest of the UK?

Yes – logistics salaries in London and major port hubs like Felixstowe or Southampton are typically higher. This reflects both demand and cost of living.

What skills move candidates into higher-pay bands?

Data analysis, compliance, negotiation and software expertise are in demand. Employers also value leadership, risk management and sustainability insight.

Which certifications help most for senior roles?

The most recognised are CILT (Chartered Institute of Logistics and Transport), Lean Six Sigma, and APICS CPIM. CPC is also all-important for transport and fleet-related leadership.

Can I move from warehouse operations into a higher-paying supply chain role?

Yes, many start as warehouse managers and move into analyst, procurement or logistics planning positions. Upskilling with software and analytics training helps that shift.

The Autumn Budget is where the government sets out its annual financial plan — from tax rates to investment priorities and new digital requirements. While much of it applies broadly to UK businesses, haulage companies will feel the impact more sharply because of high operating costs, complex compliance, and the reliance on subcontracted drivers.

The Autumn Budget 2025 introduces a mix of rising costs, new digital reporting rules and updated tax allowances that will influence how haulage firms plan fleets, manage subcontractors and run their operations in the years ahead.

Here’s a clear breakdown of what will matter most for the haulage sector.

What we’ll cover

Fleets, bookings, subcontractors, compliance & payments.

With HX, you can manage them all in one place.Fuel duty and operating costs

Fuel is one of the biggest cost pressures in road haulage, and the 2025 Budget sets out a staged increase over the next two years.

Fuel duty reversal (2026–27)

The government will reverse the temporary 5p fuel duty cut in three steps:

Date Increase Meaning 1 September 2026 +1p First stage of duty returning to 2022 levels 1 December 2026 +2p Further rise in per-litre cost 1 March 2027 +2p Full reversal complete Alongside this:

- Vehicle Excise Duty for HGVs will rise with inflation from April 2026.

- The HGV levy will also rise in line with inflation.

What this means for haulage companies: across a fleet operating thousands of miles per day, even small increases will have a compounding effect on operating costs.

Fleet investment: trucks, trailers and yard equipment

Haulage companies typically plan fleet replacement years ahead. The 2025 Budget provides several tax allowances that will ease the cost of investment — especially helpful for replacing older units or expanding capacity.

Key allowances

Allowance Applies to Runs until Benefit 100% first-year allowance (FYA) Zero-emission HGVs 31 March 2027 Deduct full cost in year one 100% FYA EV charging infrastructure 2027 Full deduction on installation 40% first-year allowance Most new trucks, plant, yard kit From Jan 2026 Faster tax relief on major assets Why this matters for haulage:

High-value assets — tractors, trailers, refrigeration units, telematics, yard handling equipment — can be timed to optimise tax relief during the 2026–27 window.Income tax, NI and business taxation

Many haulage businesses operate as limited companies, and the Autumn Budget 2025 includes several changes that will affect both directors and payroll.

Key updates

- Personal tax thresholds will remain frozen until 2031 — increasing effective tax for rising wages.

- NI thresholds will remain frozen, impacting overall labour cost across drivers, planners and admin staff.

- Dividend tax rates will increase from 2026–27, affecting directors who draw income via dividends.

- Corporation Tax will remain unchanged, but allowances will play a bigger role in tax efficiency.

Impact:

Labour will become more expensive, and margins will tighten unless businesses offset this through efficiencies.Digital compliance, invoicing and subcontractor management

This is one of the most significant areas for haulage companies — not only because of their own reporting obligations, but because many rely heavily on subcontracted drivers.

The 2025 Budget confirms a shift towards stricter digital record keeping:

Key deadlines

- April 2027: penalties for late VAT and Self Assessment filings will become tougher.

- 2027: Making Tax Digital will expand, requiring more accurate digital records across the business.

- 2029: Mandatory e-invoicing will apply to all VAT-registered businesses.

For haulage companies working with subcontractors, this will matter because:

- Clean digital audit trails will become essential for VAT, accounting and haulage insurance reviews.

- Subcontractor invoices will need to be accurate, VAT-compliant and digitally consistent.

- Payment errors — especially across large subcontractor pools — will become more expensive under the new penalty regime.

How SmartPay will help haulage companies manage these changes

SmartPay will reduce admin for both in-house fleets and subcontracted drivers, supporting the tighter compliance landscape set out in the Autumn Budget.

1. Cleaner VAT and invoice checks

SmartPay will automatically validate key VAT details, helping reduce the risk of errors and mismatched subcontractor invoices — a major pain point for haulage operations handling high volumes of third-party work.

2. Standardised digital invoices (future-proofed for 2029)

With e-invoicing becoming mandatory in 2029, SmartPay already issues consistent, structured digital invoices. This will help haulage firms maintain clean audit trails across subcontractors.

3. One-click, consolidated payments

Instead of paying subcontractors one by one, SmartPay will allow a single bulk payment covering all approved invoices — ideal for haulage businesses with complex weekly payment runs.

4. Automatic reconciliation

Each invoice will be matched automatically to its payment, reducing manual admin, preventing duplicate payments and improving accounting accuracy ahead of stricter Making Tax Digital requirements.

5. Supporting MTD for Self Assessment

SmartPay and HX will continue working with accounting software providers to support the rollout of MTD for Self Assessment, making it easier for subcontractors to stay compliant — and for haulage businesses to receive clean, standardised digital invoices from them.

The result:

Less back-office pressure, fewer payment mistakes, faster subcontractor turnaround and a more compliant end-to-end workflow.HGVs and the road to decarbonisation

While the heavy truck market is still early in its transition to zero-emission vehicles, the Budget includes several long-term measures:

- Additional investment in charging infrastructure will be made.

- EV-only forecourts and charging sites will receive 10 years of business rates relief.

- The new EV mileage tax will apply to cars only — not HGVs.

Impact:

Little will change immediately for heavy haulage, but companies with depots will benefit from infrastructure and charging incentives when planning ahead.Depots, yards and multi-site operations

Haulage companies often manage multiple depots, yards, workshops and warehouses.

Changes in the 2025 Budget include:

- Small Business Rates Relief will be extended for companies operating more than one property.

- Long-term rates relief will apply to EV charging infrastructure installed on commercial premises.

- Site expansions and yard upgrades may become more cost-effective.

Cross-border and freight-specific changes

For operators running European or import/export work:

- Customs duty relief on low-value imports (under £135) will be removed by 2029.

- HMRC will expand real-time data matching, increasing scrutiny over mixed domestic/international freight income.

- Future tax conditionality may link compliance more closely to transport licensing.

Key takeaways for haulage companies

Here’s a summary of what’s changing with the 2025 Budget:

- Fuel and fleet operating costs will rise from 2026–27.

- Tax allowances will offer opportunities for fleet and yard investment.

- Digital compliance will tighten, especially for subcontractor-heavy operations.

- E-invoicing will become mandatory in 2029, requiring consistent digital invoices.

- SmartPay will help reduce admin, prevent payment errors and support haulage companies as the industry shifts towards fully digital workflows.

Find reliable carriers and cut your costs with Haulage Exchange

Sign upFrequently asked questions

How will the Autumn Budget 2025 affect haulage operating costs?

Fuel duty will increase in stages from 2026 to 2027, HGV road tax will rise with inflation and the HGV levy will also be uprated. These changes will increase the cost per mile for haulage fleets and subcontracted vehicles, making fuel budgeting and efficient payment processes more important.

What will the 2025 Budget mean for managing subcontractors?

Stricter digital reporting, tougher VAT penalties and future e-invoicing rules will place more pressure on haulage companies to maintain accurate, consistent records for subcontracted drivers. Clean, compliant invoices will become essential, and tools like SmartPay will help standardise subcontractor invoicing and reduce payment errors.

Will the 2025 Budget introduce new compliance requirements?

Yes. From 2027, Making Tax Digital will expand, and penalties for late VAT and Self Assessment filings will become tougher. From 2029, VAT-registered businesses will be required to use structured e-invoices. Haulage companies will need digital record-keeping systems capable of handling this shift.

How will SmartPay help haulage firms prepare for these changes?

SmartPay will support compliance through automatic VAT checks, structured digital invoices and one-click bulk payments to subcontractors. These features will help haulage companies maintain clean audit trails, reduce admin and stay aligned with the tighter reporting standards introduced in the Autumn Budget 2025.

When you’re spending long hours on the road, your cab becomes more than just a vehicle; it’s your workspace, your breakroom, and sometimes even your bedroom. Packing the right gear can turn a tough journey into a manageable one and help you avoid common mishaps.

In this guide, we break down the must-have HGV driver accessories and gear that everyone should have in their trucks. From emergency kits and tools to food supplies and personal hygiene gear, you’ll find everything you need to stay safe, comfortable, and ready for the long haul, or even to inspire bold ideas for lorry driver gifts.

What we’ll cover

Fleets, bookings, subcontractors, compliance & payments.

With HX, you can manage them all in one place.Safety and emergency kit

A solid emergency kit will help you handle injuries, breakdowns, and low-visibility conditions with confidence, making it a go-to section for anyone looking for practical gifts for lorry drivers.

First aid and PPE

No one plans to get injured on the job, but even a small scrape can become a hassle without the right supplies. A well-stocked first aid kit and basic personal protection equipment can make all the difference, especially on-site.

Keep a first aid kit that includes:

- Bandages

- Antiseptic wipes

- Plasters

- Painkillers

- and be sure to check expiry dates regularly.

If you’re visiting depots, construction zones, or ports; make sure you have:

- High-vis gear

- Steel-toe boots

- A hard hat

- Safety gloves

Some sites have their own PPE rules, so it’s worth carrying extra items just in case.

It’s not just about compliance; proper gear helps prevent injury in unpredictable environments.Breakdown and visibility gear

If you break down on a hard shoulder or in poor visibility, it’s your job to stay safe while you wait for help. That means being seen by other drivers and staying protected from the elements.

You should be carrying:

- A reflective jacket

- Warning triangles

- A torch or headlamp

- Spare batteries

Winter extras:

- Jump leads

- A high-grip mat

- An emergency foil blanket (can be lifesavers in freezing conditions)

- A portable tyre inflator or sealant helps with slow punctures if you’re miles from a garage)

- A high-vis vest (could be what keeps you safe at night or in heavy rain)

These are both top picks when shopping for HGV driver gifts with real purpose.

Tools and basic maintenance

Even if you’re not a trained mechanic, having a few tools can get you out of trouble. They help you fix minor issues before they turn into major delays.

You should always have:

- A small tool kit with pliers

- Screwdrivers

- An adjustable wrench

- Duct tape

- Zip ties

- WD-40

- A tyre pressure gauge

- Gloves for dirty work

Keep spare bulbs and fuses handy, especially if you’re driving long distances at night. A multi-tool or Swiss Army knife is also useful, you’ll be surprised how often it comes in handy, making it one of the top truck driver accessories.

Navigation, comms and documents

Staying on track and in contact is a big part of the job. A few small tools can help you plan better, stay legal, and avoid missed delivery windows.

An HGV-friendly sat nav is better than your smartphone when it comes to height, weight, and route restrictions. Make sure you also carry a phone charger or power bank to keep your devices topped up.

As you’ll read in any guide on how to become an HGV driver, you’ll need to keep a few things on you at all times.

This includes:

- Your driver CPC card,

- Tacho card

- Any required delivery documents on hand when you set off.

A simple clipboard or folder can also help you keep paperwork neat and ready for inspection. So, consider these as functional lorry driver accessories for day-to-day convenience.

Food, water and simple cooking

Eating well on the road isn’t just about saving money; it’s about feeling good and staying alert. A small setup can go a long way when you’re tired, hungry, and miles from the next café.

Stock a cool bag or 12V fridge for perishables, along with high-protein snacks like nuts, bars, and jerky. A travel kettle or camping stove opens the door to proper meals, and even a tin of soup or noodles feels like luxury on a cold night.

Don’t forget the basics!

- Water (at least 2 litres per day)

- A reusable mug

- Cutlery

- A bowl

Some drivers also pack sachets of coffee, instant porridge, or seasoning to spice things up.

These small comforts are often overlooked. However, they make excellent gifts for lorry drivers who spend long stretches on the road.

Bedding and sleep comfort

If you’re tramping, sleep is your fuel, and poor sleep makes long drives harder and more dangerous. A well-kitted sleeping area helps you rest properly and wake up ready for the road.

- A quality sleeping bag

- Pillow

- Blackout curtains (make a huge difference)

- Earplugs

- An eye mask (or even a white noise app to help block out noisy lay-bys)

Don’t overlook a spare blanket or a fitted sheet to cover your bunk, keeping your bed setup clean and comfy can improve your mood, energy and even your safety. For those sleeping in their cabs, sleep gear also counts among thoughtful lorry driver gifts that show you care about their rest.

Clothing and personal hygiene

It’s hard to stay comfortable or focused if you’re cold, damp or feeling unclean. Packing the right extras can keep you fresh and focused from one job to the next.

Pack spare workwear, waterproofs, a warm hoodie and a towel. Trainers or sliders are good for rest stops, and quick-dry fabrics save space and time.

In your washbag, keep:

- A toothbrush

- Deodorant

- Wipes

- A razor

- Some toilet paper

Add hand sanitiser and flip-flops if you’re planning to use communal showers.

Weather kit and seasonal extras

British weather can flip in minutes, and being caught out in the wrong gear is more than just uncomfortable; it can be dangerous. A compact weather kit helps you adapt quickly and stay safe in all conditions.

For winter, carry:

- A windscreen scraper

- De-icer spray

- Thermal gloves

- A warm hat

It’s also worth keeping a shovel and sand or cat litter in case you get stuck on icy roads.

In summer? A cap, sunscreen, and portable fan go a long way during long, hot waits.

If you regularly cross into Europe, remember some countries require winter tyres or snow chains, pack accordingly. Many of these seasonal items double as clever HGV accessories for UK or cross-border hauliers.

Loading and unloading equipment

Even if loading isn’t your main job, a little kit can help speed things up. It also shows you’re prepared, which goes a long way with depot staff and site managers.

For loading and unloading carry:

- Gloves,

- Steel-toe boots

- Load ratchet straps

- Hi-vis gear

A portable step or pallet truck might also come in handy, especially at smaller depots.

Before you leave, always check your load is secure, even if it’s a short hop between stops. Loose cargo is one of the most common causes of delivery delays and accidents.

Cleaning and cab organisation

You spend most of your day in your cab, so it’s worth keeping it clean and functional. It makes eating, sleeping, and even driving feel less like a chore.

Use dashboard wipes and cloths to keep surfaces dust-free, and bin bags for any rubbish.

A small broom or handheld vacuum helps with dirt tracked in from your boots, and storage boxes, hanging seat organisers, and crates keep everything in reach.An air freshener or microfibre cloth for the windows can also make your space feel more like home. From storage hacks to dashboard wipes, these are great ideas if you’re browsing for lorry driver gifts with a personal touch.

Entertainment and wellbeing

Life on the road can feel repetitive, so it’s important to bring things that lift your mood. When you’re stuck in a lay-by or waiting at a depot, entertainment helps pass the time.

Pack headphones and pre-download podcasts, audiobooks, or playlists.

A Kindle, sketchpad, or journal offers a screen-free break, and puzzles or games help kill time too.Don’t underestimate physical wellbeing either, resistance bands, a quick stretch, or a walk around the lay-by can refresh your body and mind. Even small moments of rest and joy matter, so whether it’s podcasts, books or fitness bands, entertainment gear is one of the more underrated truck driver accessories on the road.

Long-haul tramping extras

If you’re regularly away for days at a time, consider indulging yourself beyond the basics. These extras won’t just keep you comfortable, they can make the road feel more like home.

Drivers often carry:

- Fold-out chairs

- Travel kettles

- Extra cutlery

- Mini mirrors

- USB fan or heater

- A small TV

- Phone stands

- Dry food containers

- Extra socks

Find reliable carriers and cut your costs with Haulage Exchange

Sign upFrequently asked questions

What are the legal requirements for UK HGV driver equipment?

You must carry your CPC card, tacho card, and any relevant documents for the load you’re hauling. Hi-vis gear is recommended, and some international routes require extra items like warning triangles or breathalysers.

What should I pack for bad weather or breakdowns?

In winter, bring a foil blanket, gloves, warm clothes, and a tow rope or high-grip mat. All year round, carry a hi-vis vest, torch, warning triangle, and a power bank.

How can I improve sleep in my cab?

Block out noise and light using curtains, earplugs, or white noise apps. A proper duvet, pillow, and spare blanket will also help you get quality rest between shifts.

Thinking about a career move into freight brokering? Whether you’re already in logistics or starting fresh, becoming a freight broker in the UK opens up a world of opportunity.

In this guide, we’ll break down everything you need to know, from what the role involves to setting up your own freight brokerage business.

What we’ll cover

Fleets, bookings, subcontractors, compliance & payments.

With HX, you can manage them all in one place.What is a freight broker?

A freight broker is a middleman between shippers who need to move goods and carriers who can transport them.

They don’t handle the freight directly but use their network and industry know-how to match the right haulier with the right job.

If you’re still wondering what a freight broker is, think of them as the connector keeping supply chains moving efficiently.

The role of freight brokers in the supply chain

Freight brokers play an important part in optimising logistics. They negotiate rates, organise loads, and make sure goods are delivered on time.

While they don’t typically take responsibility for the cargo, unlike freight forwarders, understanding the differences between freight brokers and freight forwarders is important for knowing how each supports the supply chain.

Understanding the UK freight market

The UK’s freight market is fast-paced and highly competitive. With growing demand for domestic and international haulage, there’s definitely space for new brokers who can offer reliable, responsive service.

Digital tools and platforms like freight exchange networks have made the barrier to entry much lower.

Freight brokers in the UK often work across road, sea, and air logistics, giving them a flexible model. Most start with road freight, partnering with HGV drivers, smaller haulage companies and even courier companies. It’s also common to begin by helping companies secure return loads to increase profits and minimise empty journeys.

Regulatory considerations for UK freight brokering

Unlike in the US, you don’t need a freight broker licence in the UK—but that doesn’t mean there are no rules. You’ll need to follow standard trading and data protection regulations.

If you operate vehicles, you’ll also need an operator licence, but pure brokers don’t typically require one. That said, having proper contracts and freight agreements in place is important. So is understanding how the haulage industry works, from liability to scheduling.

If you’re brokering on behalf of multiple carriers, having the right freight forwarder insurance is essential.

How to become a freight broker

So, how do you become a freight broker in the UK? It’s more accessible than you might think, but success comes from preparation, professionalism, and building strong industry connections.

Let’s look at each of the major steps:

1. Education required

You don’t need a formal degree to get started, but a solid understanding of logistics and supply chain management helps. Many brokers come from haulage, admin, or customer service backgrounds. Courses in transport management or freight forwarding can give you an edge.

If you’re completely new to the industry, it’s worth learning the basics of how freight and transport bidding platforms work. These tools help you find loads, negotiate rates, and match carriers to jobs. Learning the tech side early sets you up for smoother operations later.

Even if you’re self-taught, staying informed is key. Keep an eye on freight regulations, market trends, and digital platforms. You can also read our other guides here on Freight Focus.

2. Licensing, bonding, and insurance essentials

Although UK freight brokers don’t require a specific broker licence, you should still operate as a registered business. That means choosing a business structure, registering with HMRC, and understanding your tax obligations. You’ll also want to consider professional indemnity insurance or carrier liability cover.

If you plan to handle freight directly or operate vehicles, you’ll need an operator licence. If you’re purely brokering freight between other parties, insurance is still vital to protect your business. Make sure your contracts are clear, especially regarding who is liable for damage or delays.

3. Setting up your freight brokerage business

You’ll need a business plan, basic tech setup, and a way to manage quotes, loads, and communications. Many brokers start from home, using load boards, freight exchange platforms, and spreadsheet tools to stay organised. As you grow, software like TMS (transportation management systems) can help automate operations.

Decide whether you’ll specialise: maybe small haulage, international freight, or urgent loads. You could focus on return loads to reduce waste and help carriers earn more per trip. The key is finding a niche and building a reputation for reliability.

At this stage, it’s also worth considering branding and marketing. A clear website, professional email, and reliable contact methods make you easier to trust. Being organised and responsive will set you apart and help you grow your freight forwarding company.

The key skills and qualities for success

- Time management and multitasking: You’ll often be managing several loads at once, fielding calls, updating clients, and handling admin. Staying organised helps avoid errors and keeps everyone on schedule. A reliable broker is a busy one, but never overwhelmed.

- Strong communication: Freight brokers need to be clear, concise, and responsive. Whether it’s confirming a booking or handling a delay, the way you communicate can build or break relationships. Carriers and shippers both appreciate someone who keeps them in the loop.

- Negotiation skills: Brokers sit between two parties with different goals—shippers want low costs, carriers want fair pay. It’s your job to find middle ground that works for both. Over time, good negotiators earn better margins and build stronger loyalty.

- Understanding how the industry works: You don’t need decades of experience, but you do need to understand how do freight brokers work, what makes a good route, and where delays typically happen. Knowing your stuff builds confidence and helps you solve problems fast. Clients trust brokers who know more than just the basics.

- Digital literacy and tech tools: From freight exchange platforms to tracking tools and CRMs, tech is central to modern freight brokering. The more comfortable you are with software, the smoother your operations will run. Automation also frees up your time for building relationships.

Best practices for freight brokers

If you want to stand out, focus on building long-term relationships, not just quick wins. Good brokers stay in regular contact with both shippers and hauliers, keeping communication clear and professional. This helps build trust, leading to repeat business.

Strong communication and negotiation skills are essential. That includes setting expectations, managing delays, and finding fair rates for everyone involved. Freight moves fast, and so should your updates.

When it comes to marketing your brokerage, don’t just rely on word-of-mouth. Like we said before, a clean, professional website and active presence on digital load boards make you easier to find. If you’re unsure where to start, look into platforms that support transport bidding for smaller jobs to build your network.

Freight brokerage startup costs

Starting a freight brokerage is relatively low-cost, especially if you’re working remotely or solo. You’ll need to budget for business registration, basic insurance, and tech tools. If you plan to grow, consider CRM software or even hiring admin support.

You make money by charging a margin between what the carrier gets and what the shipper pays. This margin varies, but the more efficient and trusted you are, the better rates you can negotiate. Learning how to become a freight broker agent can also be a stepping stone if you want to gain experience before launching your own company.

It’s also important to keep track of taxes, invoice terms, and late payment risks. Cash flow can be tight in the early months, so set clear payment terms and keep records. As your business scales, outsourcing bookkeeping may save you time and stress.

Challenges in freight brokering

Every job has its hurdles, and freight brokering is no exception. From carrier no-shows to last-minute cancellations, things don’t always go to plan. Staying calm and finding quick solutions is part of the job.

Brokers also face the challenge of keeping both shippers and carriers happy, while still protecting their own margins. It’s a balancing act that takes time to get right. If you’re wondering how to become a broker for freight and actually thrive, knowing the common pitfalls is a good place to start.

Common mistakes and how to avoid them

- Poor communication: Missed updates or unclear instructions can quickly damage trust with carriers and clients. Always confirm key details in writing and follow up regularly to keep everyone informed.

- Overpromising: Taking on too much too soon can lead to failed deliveries and missed deadlines. Start small, know your limits, and scale your workload as your systems and network grow.

- Relying on one client or carrier: Without a diverse network, one cancellation could disrupt your entire week. Spread your workload across multiple contacts to keep your business stable and flexible.

- Bad record-keeping: Failing to track quotes, contracts, or delivery notes can cause billing errors and disputes. Use simple spreadsheets or digital tools to stay organised and keep everything in one place.

- Not setting clear terms: Skipping formal agreements leads to confusion about responsibility, payment, or delivery expectations. Always outline who’s responsible for what before a job begins, and stick to written terms.

Future trends in freight brokering

Digital tools are reshaping the industry, and that’s good news for new brokers. Platforms now use automation, instant pricing, and real-time tracking to streamline freight matching. If you’re learning how to become a freight broker UK, it’s smart to stay ahead of the tech curve.

Sustainability is also becoming a bigger priority. Brokers who can optimise routes and reduce empty miles—like through return loads—will be more valuable. Clients want partners who help them meet green goals.

Lastly, demand for transparency is rising. Shippers expect live updates, reliable service, and easy communication. Brokers who offer that will likely stand out from the crowd.

Find reliable carriers and cut your costs with Haulage Exchange

Sign upFrequently asked questions

What makes a freight broker successful?

A successful freight broker builds strong relationships, communicates clearly, and consistently delivers value. It’s not just about moving loads, it’s about being reliable, responsive, and resourceful.

How profitable is a freight brokerage?

Freight brokering can be very profitable, especially if you operate efficiently and build a loyal customer base. Margins vary, but with low overheads and repeat business, brokers can earn a strong income.

How do I get customers as a freight broker?

Start by networking with carriers and shippers, joining online load boards, and offering your services on freight exchange platforms. Word-of-mouth is powerful, but so is having a professional presence online.

Buying a used HGV can be one of the smartest ways to grow your fleet without overspending. But with so many factors to consider – from emissions standards to ownership checks – it’s easy to make an expensive mistake.

In this guide, we’ll cover everything you need to know before you buy a second-hand HGV, from understanding your operational needs to calculating long-term costs.

What we’ll cover

Fleets, bookings, subcontractors, compliance & payments.

With HX, you can manage them all in one place.Buy new or second-hand – which is right for your business?

When it comes to expanding your fleet, deciding between a brand-new and a used HGV comes down to your priorities: cost, reliability, and flexibility.

Both have clear advantages — but also some trade-offs.

Buying a new HGV:

- Comes with a full manufacturer warranty and no prior wear.

- You’ll get access to a wider range of different lorry types.

- Meets the latest emissions and freight transport standards out of the box.

- Often includes telematics, safety tech, and low-emission compliance for cold chain transport and urban work.

- But you’ll pay a premium, wait longer for delivery, and face faster depreciation in the first few years.

Buying a used HGV: